A) Coefficient of correlation

B) Coefficient of variation

C) Standard deviation of returns

D) Net present value

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

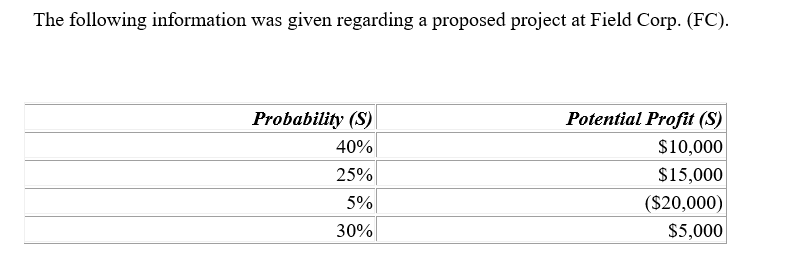

-This project's expected profit is ________.

-This project's expected profit is ________.

A) $5,000

B) $5,499

C) $8,250

D) $12,890

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The coefficient of variation (V) can be defined as the:

A) expected value multiplied by the standard deviation.

B) standard deviation divided by the mean (expected value) .

C) mean (expected value) divided by the standard deviation.

D) standard deviation squared, divided by the expected value.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a common approach in dealing with uncertainty?

A) Monte Carlo simulation

B) Internal rate of return

C) Net present value

D) Beta analysis

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Beta is a better risk measure than standard deviation when the firm:

A) is effectively diversified.

B) focused on total risk.

C) uses the CAPM in its cost of capital calculation.

D) has a beta that is close to 1.0.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of beta?

A) Beta measures only the volatility of returns on an individual bond relative to a bond market index.

B) A beta of 1.0 is of equal risk with the market.

C) A beta of greater than 1.0 has less risk than the market.

D) Beta measures the correlation between the risk free rate and the market rate of risk.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Choosing projects with returns equal to the company norm but having a higher level of risk will most likely lower the company's share price.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

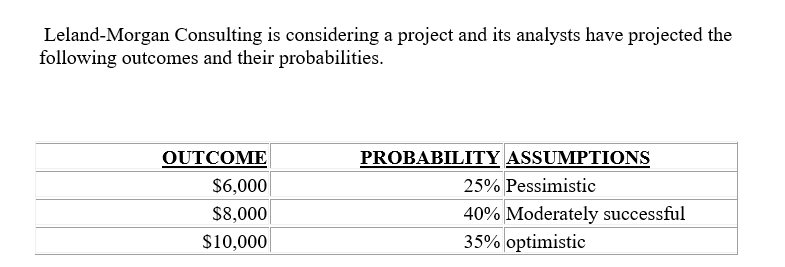

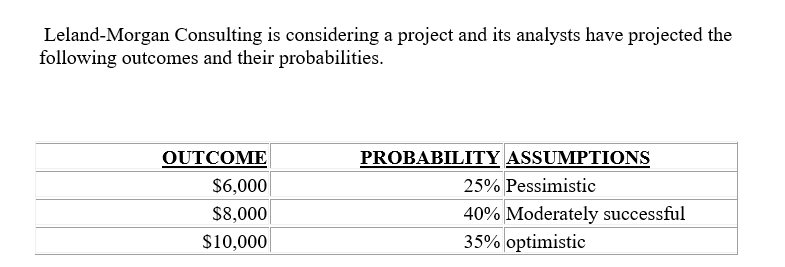

-What is the expected value of the outcomes?

-What is the expected value of the outcomes?

A) $8,200

B) $6,400

C) $8,500

D) Cannot be determined until we know the actual outcome.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The efficient frontier is always along the left-most portion of the risk-return tradeoff diagram.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's highest risk-adjusted discount should be applied to:

A) the repair of old machinery.

B) a new product in a related field.

C) a new product in a foreign market.

D) the purchase of new equipment.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement?

A) Risky investments may produce large losses.

B) Risky investments will not produce large gains.

C) The coefficient of variation is not a risk measure.

D) All risky investments have a high probability of succeeding.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A correlation coefficient of zero indicates:

A) the projects have the same expected value.

B) there is no correlation and no risk reduction between combined projects.

C) there is no correlation, but some risk reduction when the projects are combined.

D) the projects have the same standard deviation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

An analyst's ability to diversify away risk diminishes over time.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The term "risk averse" means that:

A) an individual refuses to take risks.

B) most investors and businesspersons seek risk.

C) an individual will seek to avoid risk or be compensated with a higher return.

D) only investment proposals with no risk should be accepted.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The highest possible value for positive correlation is +1.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-What is the coefficient of variation of the outcomes?

-What is the coefficient of variation of the outcomes?

A) 1.29

B) 0.19

C) 0.44

D) Cannot be determined with the information given

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to reduce risk in a firm, the firm would seek to enter a business that:

A) has high positive correlation with its present business.

B) has zero correlation with its present business.

C) has high negative correlation with its present business.

D) has high negative variation with its present business.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 97 of 97

Related Exams