Correct Answer

verified

Correct Answer

verified

Multiple Choice

The forward exchange rate quoted for the remaining term of a forward contract is used to account for the contract when the forward contract:

A) extends beyond one year or the current operating cycle.

B) is a hedge of an identifiable foreign currency commitment.

C) is a hedge of an exposed net liability position.

D) was acquired to speculate in foreign currency.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

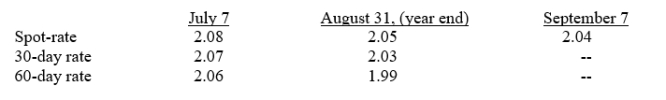

Madison Paving Company purchased equipment for 350,000 British pounds from a supplier in London on July 7, 2014.Payment in British pounds is due on Sept.7, 2014.The exchange rates to purchase one pound is as follows:  On its August 31, 2014 income statement, what amount should Madison Paving report as a foreign exchange transaction gain:

On its August 31, 2014 income statement, what amount should Madison Paving report as a foreign exchange transaction gain:

A) $14,000.

B) $7,000.

C) $10,500.

D) $0.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

With respect to disclosure requirements for fair value measurements, which of the following is not be consistent with indicating negatives - I suggest bold and not underlining one of the three levels in the hierarchy of classifying fair value measurements?

A) a reconciliation of beginning and ending balances

B) significant unobservable inputs

C) significant other observable inputs

D) quoted prices in active markets for identical assets or liabilities

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The exchange rate quoted for future delivery of foreign currency is the definition of a(n) :

A) direct exchange rate.

B) indirect exchange rate.

C) spot rate.

D) forward exchange rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

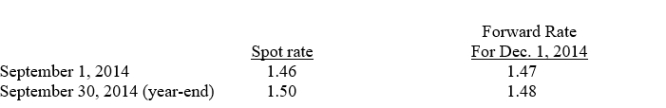

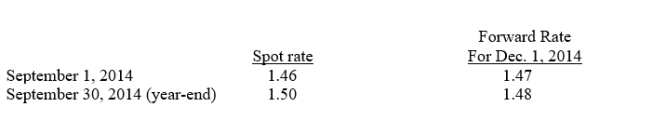

On September 1, 2014, Mudd Plating Company entered into two forward exchange contracts to purchase 250,000 euros each in 90 days.The relevant exchange rates are as follows:  The second forward contract was strictly for speculation.On September 30, 2014, what amount of foreign currency transaction gain should Mudd Plating report in income?

The second forward contract was strictly for speculation.On September 30, 2014, what amount of foreign currency transaction gain should Mudd Plating report in income?

A) $0.

B) $2,500.

C) $5,000.

D) $10,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the viewpoint of a U.S.company, a foreign currency transaction is a transaction:

A) measured in a foreign currency.

B) denominated in a foreign currency.

C) measured in U.S.currency.

D) denominated in U.S.currency.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

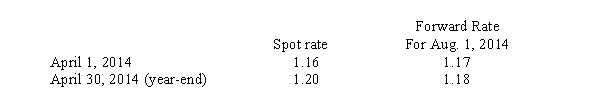

On April 1, 2014, Manatee Company entered into two forward exchange contracts to purchase 300,000 euros each in 90 days.The relevant exchange rates are as follows:  The second forward contract was strictly for speculation.On April 30, 2014, what amount of foreign currency transaction gain should Manatee report in income.

The second forward contract was strictly for speculation.On April 30, 2014, what amount of foreign currency transaction gain should Manatee report in income.

A) $0.

B) $3,000.

C) $9,000.

D) $12,000.

F) A) and C)

Correct Answer

verified

B

Correct Answer

verified

Multiple Choice

A transaction gain is recorded when there is an:

A) importing transaction and the exchange rate increases.

B) exporting transaction and the exchange rate increases.

C) exporting transaction and the exchange rate decreases.

D) none of these.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transaction gain or loss on a forward contract entered into as a hedge of an identifiable foreign currency commitment may be:

A) included as a separate item in the stockholders' equity section of the balance sheet.

B) recognized currently in the determination of net income.

C) deferred and included in the measurement of the related foreign currency transaction.

D) none of these.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An indirect exchange rate quotation is one in which the exchange rate is quoted:

A) in terms of how many units of the domestic currency can be converted into one unit of foreign currency.

B) for the immediate delivery of currencies exchanged.

C) in terms of how many units of the foreign currency can be converted into one unit of domestic currency.

D) for the future delivery of currencies exchanged.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transaction loss would result from:

A) an increase in the exchange rate applicable to an asset denominated in a foreign currency.

B) a decrease in the exchange rate applicable to a liability denominated in a foreign currency.

C) the import of merchandise when the transaction is denominated in a foreign currency.

D) a decrease in the exchange rate applicable to an asset denominated in a foreign currency.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A discount or premium on a forward contract is deferred and included in the measurement of the related foreign currency transaction if the contract is classified as a:

A) hedge of a net investment in a foreign entity.

B) hedge of an exposed asset or liability position.

C) hedge of an identifiable foreign currency commitment.

D) contract acquired to speculate in the movement of exchange rates.

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Short Answer

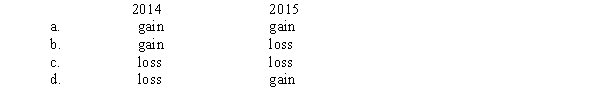

During 2014, a U.S.company purchased inventory from a foreign supplier.The transaction was denominated in the local currency of the seller.The direct exchange rate increased from the date of the transaction to the balance sheet date.The exchange rate decreased from the balance sheet date to the settlement date in 2015.For the years 2014 and 2015, transaction gains or losses should be recognized as:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

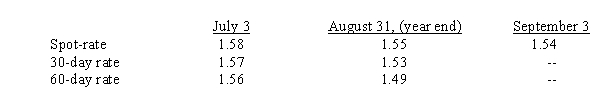

Kettle Company purchased equipment for 375,000 British pounds from a supplier in London on July 3, 2014.Payment in British pounds is due on Sept.3, 2014.The exchange rates to purchase one pound is as follows:  On its August 31, 2014, income statement, what amount should Kettle report as a foreign exchange transaction gain:

On its August 31, 2014, income statement, what amount should Kettle report as a foreign exchange transaction gain:

A) $18,750.

B) $3,750.

C) $11,250.

D) $0.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A transaction gain or loss at the settlement date is:

A) a change in the exchange rate quoted by a foreign exchange trader.

B) synonymous with the translation of foreign currency financial statements into dollars.

C) the difference between the recorded dollar amount of an account receivable denominated in a foreign currency and the amount of dollars received.

D) the difference between the buying and selling rate quoted by a foreign exchange trader at the settlement date.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Montana Corporation a U.S.company, contracted to purchase foreign goods.Payment in foreign currency was due one month after delivery.Between the delivery date and the time of payment, the exchange rate changed in Montana's favor.The resulting gain should be reported in the financial statements as a(n) :

A) component of other comprehensive income.

B) component of income from continuing operations.

C) extraordinary income.

D) deferred income.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The discount or premium on a forward contract entered into as a hedge of an exposed asset or liability position should be:

A) included as a separate component of stockholders' equity.

B) amortized over the life of the forward contract.

C) deferred and included in the measurement of related foreign currency transaction.

D) none of these.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On September 1, 2014, Mudd Plating Company entered into two forward exchange contracts to purchase 250,000 euros each in 90 days.The relevant exchange rates are as follows:  The first forward contract was to hedge a purchase of inventory on September 1, payable on December 1.On September 30, what amount of foreign currency transaction loss should Mudd Plating report in income?

The first forward contract was to hedge a purchase of inventory on September 1, payable on December 1.On September 30, what amount of foreign currency transaction loss should Mudd Plating report in income?

A) $0.

B) $2,500.

C) $5,000.

D) $10,000.

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Short Answer

Greco, Inc.a U.S.corporation, bought machine parts from Franco Company of Germany on March 1, 2014, for 70,000 marks, when the spot rate for marks was $0.5395.Greco's year-end was March 31, 2014, when the spot rate for marks was $0.5445.Greco bought 70,000 marks and paid the invoice on April 20, 2014, when the spot rate was $0.5495.How much should be shown in Greco's income statements as foreign exchange (transaction) gain or loss for the years ended March 31, 2014 and 2015?

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 25

Related Exams