Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which inventory method generally results in costs allocated to ending inventory that will approximate their current cost?

A) LIFO

B) FIFO

C) Average cost method

D) Whichever method that produces the highest ending inventory figure

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a company has no beginning inventory and the unit price of inventory is increasing during a period, the cost of goods available for sale during the period will be the same under the LIFO and FIFO inventory methods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In periods of rising prices, the inventory method which results in the inventory value on the balance sheet that is closest to current cost is the

A) FIFO method.

B) LIFO method.

C) average-cost method.

D) tax method.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sassy Saxophones has the following inventory data:  Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a LIFO basis?

Assuming that a periodic inventory system is used, what is the amount allocated to ending inventory on a LIFO basis?

A) $18,320

B) $18,370

C) $38,480

D) $38,530

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The FIFO inventory method results in an ending inventory valued at the most recent cost.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The lower-of-cost-or-net-realizable-value rule implies that it is unacceptable to report inventory at a cost that is in excess of its net realizable value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

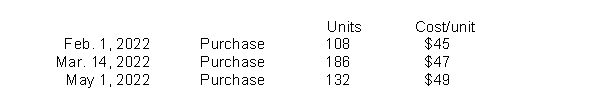

Hogan Industries had the following inventory transactions occur during 2022:  The company sold 306 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used and operating expenses of $1,800, what is the company's after-tax income using FIFO? (rounded to whole dollars)

The company sold 306 units at $63 each and has a tax rate of 30%.Assuming that a periodic inventory system is used and operating expenses of $1,800, what is the company's after-tax income using FIFO? (rounded to whole dollars)

A) $2,832

B) $3,288

C) $2,302

D) $1,982

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An aircraft company would most likely have a

A) high inventory turnover.

B) low profit margin.

C) high volume.

D) low inventory turnover.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

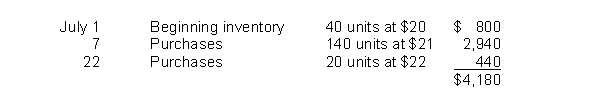

Grape Gratuities Company has the following inventory data:  A physical count of merchandise inventory on July 30 reveals that there are 50 units on hand.Using the FIFO inventory method, the amount allocated to ending inventory for July is

A physical count of merchandise inventory on July 30 reveals that there are 50 units on hand.Using the FIFO inventory method, the amount allocated to ending inventory for July is

A) $1,170.

B) $1,010.

C) $1,070.

D) $1,100.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Independent internal verification of the physical inventory process occurs when

A) the employee is required to count all items twice for sake of verification.

B) the items counted are compared to the inventory account balance.

C) a second employee counts the inventory and compares the result to the count made by the first employee.

D) all prenumbered inventory tags are accounted for.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

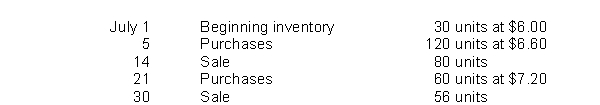

Classic Floors has the following inventory data:  Assuming that a perpetual inventory system is used, what is the value of ending inventory on a LIFO basis for July?

Assuming that a perpetual inventory system is used, what is the value of ending inventory on a LIFO basis for July?

A) $931.20

B) $1,404.00

C) $708.00

D) $472.80

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

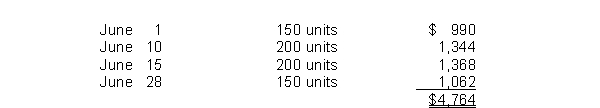

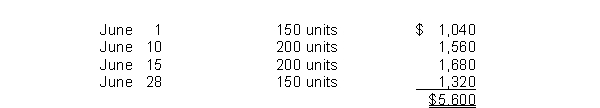

Quark Inc.just began business and made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.Using the FIFO inventory method, the amount allocated to ending inventory for June is

A physical count of merchandise inventory on June 30 reveals that there are 200 units on hand.Using the FIFO inventory method, the amount allocated to ending inventory for June is

A) $1,326.

B) $1,320.

C) $1,404.

D) $1,416.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Snug-As-A-Bug Blankets has the following inventory data:  Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis for July?

Assuming that a perpetual inventory system is used, what is the ending inventory on a LIFO basis for July?

A) $5,496

B) $5,508

C) $5,544

D) $5,796

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

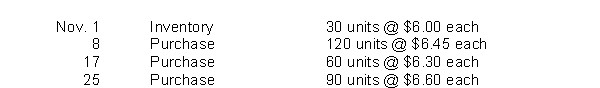

Delightful Discs has the following inventory data:.  A physical count of merchandise inventory on November 30 reveals that there are 100 units on hand.Ending inventory under LIFO is

A physical count of merchandise inventory on November 30 reveals that there are 100 units on hand.Ending inventory under LIFO is

A) $657

B) $632

C) $1,269

D) $1,295

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Under a periodic inventory system, the merchandise on hand at the end of the period is determined by a physical count of the inventory.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A problem with the specific identification method is that

A) inventories can be reported at actual costs.

B) management can manipulate income.

C) matching is not achieved.

D) the lower of cost or market basis cannot be applied.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In accounting for inventory, the assumed flow of costs must match the physical flow of goods.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Baker Bakery Company just began business and made the following four inventory purchases in June:  A physical count of merchandise inventory on June 30 reveals that there are 210 units on hand.Using the FIFO inventory method, the amount allocated to ending inventory for June is

A physical count of merchandise inventory on June 30 reveals that there are 210 units on hand.Using the FIFO inventory method, the amount allocated to ending inventory for June is

A) $1,456

B) $1,508

C) $1,824

D) $1,848

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When is a physical inventory usually taken?

A) When goods are not being sold or received.

B) When the company has its greatest amount of inventory.

C) At the end of the company's fiscal year.

D) When the company has its greatest amount of inventory and at the end of the company's fiscal year.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 189

Related Exams