A) horizontal

B) vertical

C) conglomerate

D) international

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Robinson-Patman Act of 1936 was passed in an attempt to

A) strengthen unions' powers to deal with businesses during the Great Depression.

B) close the loophole that remained in the Clayton Act with respect to mergers.

C) decrease the failure rate of small businesses.

D) protect consumers from large retailers who were receiving price discounts from their suppliers but were not passing on the price savings to the consumers.

E) protect all U.S.businesses from foreign competition during the Great Depression.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

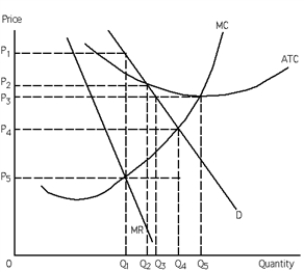

Exhibit 25-1

-Refer to Exhibit 25-1. What price is charged if marginal-cost price regulation is imposed on the natural monopoly firm?

-Refer to Exhibit 25-1. What price is charged if marginal-cost price regulation is imposed on the natural monopoly firm?

A) P1

B) P2

C) P3

D) a price below P2 and above P1

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is true?

A) The more broadly a market is defined, the less likely a firm will be considered a monopoly.

B) The Celler-Kefauver Antimerger Act was designed to close the merger loophole that existed in the Clayton Act.

C) The Sherman Act declared illegal acts that constitute restraint of trade.

D) a and b

E) a, b, and c

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following statement, "Every contract, combination in the form of trust or otherwise, or conspiracy, in restraint of trade or commerce among the several states, or with foreign nations, is hereby declared illegal," is part of the

A) Clayton Act.

B) Sherman Act.

C) Federal Trade Commission Act.

D) Wheeler-Lea Act.

E) Celler-Kefauver Antimerger Act.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If government regulators guarantee a natural monopolist that it will earn normal profits, then the monopolist will

A) achieve resource-allocative efficiency.

B) charge a price above average total cost.

C) produce a quantity of output at which marginal revenue equals price.

D) none of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The act that set up a commission to deal with "unfair methods of competition" was the

A) Sherman Act.

B) Wheeler-Lea Act.

C) Celler-Kefauver Antimerger Act.

D) Clayton Act.

E) none of the above

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If average total costs for a natural monopoly are declining where they intersect the demand curve, and government regulators set the price equal to marginal cost, then the firm will

A) likely earn a profit.

B) likely break even.

C) likely suffer a loss.

D) surely go out of business.

E) There is not enough information to answer this question.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The public interest theory of regulation holds that

A) regulators are seeking to do and will do through regulation what is in the best interest of the public or society at large.

B) even though regulators seek to do what is in the best interest of the public at large, through regulation they end up doing what is in the best interest of the special interests of the industry that is being regulated.

C) even though regulators seek to do what is in the best interest of special interests of the industry that is being regulated, through regulation they end up doing what is in the best interest of the public at large.

D) regulators are seeking to do and will do through regulation what is in the best interest of the special interests of the industry that is being regulated.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The market shares (in percentage terms) for the 10 firms that comprise an industry are 22, 18, 14, 10, 9, 7, 6, 6, 4, and 4. The Herfindahl index is __________ and the four-firm concentration ratio is __________.

A) 1,338; 64 percent

B) 1,338; 36 percent

C) 1,000; 48 percent

D) 1,104; 64 percent

E) none of the above

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Natural monopolies can be regulated based on price, profit, or output.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Herfindahl index measures the

A) degree of concentration in an industry.

B) size of a market in terms of total dollar sales.

C) degree to which average variable cost is higher than average fixed cost at every level of output.

D) the amount of deceptive and false advertising in an industry.

E) none of the above

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose an industry consists of five equal-sized firms. Two of the firms plan to merge. The merger ______________ raise anti-trust concerns at the Justice Department given that the Herfindahl index before the merger was _____________ and the merger would cause the Herfindahl index to rise by __________.

A) would; between 1,000 and 1,800; more than 100

B) would; greater than 1,800; more than 100

C) would not; less than 1,000; less than 300

D) would not; between 1,000 and 1,800; less than 100

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of a network good?

A) Facebook

B) Microsoft Excel

C) Microsoft Word

D) all of the above

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

When it comes to network goods, being one of the first companies in a market seems to really pay off.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Exhibit 25-40

-Refer to Exhibit 25-4. The problem with average-cost pricing regulation is that once it is in place, there is a tendency for the

-Refer to Exhibit 25-4. The problem with average-cost pricing regulation is that once it is in place, there is a tendency for the

A) D curve to shift rightward.

B) D curve to shift leftward.

C) ATC curve to shift upward.

D) ATC curve to shift downward.

E) MR curve to shift leftward.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For a natural monopoly firm, the resource-allocative efficient output is 200 units. The highest per-unit price that can be charged for this output is $3. Average total cost at 200 units is $3.50. For the natural monopoly firm that produces and sells 200 units of output,

A) marginal cost is below its average total cost.

B) it takes losses of $0.50 per unit.

C) fixed costs must be zero.

D) a and b

E) b and c

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

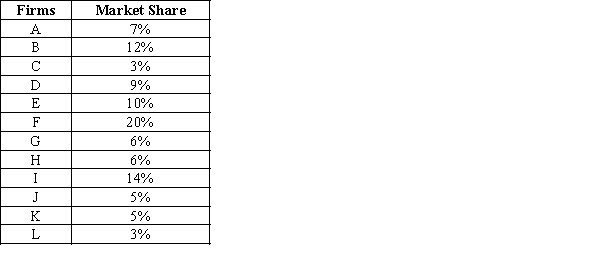

Exhibit 25-3

-Refer to Exhibit 25-3. The Justice Department would consider this industry to be

-Refer to Exhibit 25-3. The Justice Department would consider this industry to be

A) concentrated, because the top four firms together control more than 50 percent of the market share.

B) concentrated, because there are fewer than 15 firms in the industry.

C) unconcentrated, because there are more than 10 firms in the industry.

D) moderately concentrated, because the Herfindahl index is between 1,000 and 1,800.

E) unconcentrated, because the Herfindahl index is less than 1,000.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Federal Trade Commission Act of 1914 declared illegal

A) interlocking directorates.

B) anticompetitive mergers that occurred as a result of one company acquiring the physical assets of another company.

C) unfair or overly aggressive methods of competition.

D) price discounting of goods supplied to large sellers.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The existence of switching costs in the use of computer software means that buyers of computer software are __________ likely to change software programs than would be the case in the absence of switching costs, and therefore, the maker of the software program may have __________ reason to innovate.

A) less; more

B) less; less

C) more; more

D) more; less

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 80 of 158

Related Exams