A) 0.97

B) 1.08

C) 1.20

D) 1.33

E) 1.47

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Although a full liquidity analysis requires the use of a cash budget, the current and quick ratios provide fast and easy-to-use measures of a firm's liquidity position.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover and current ratio are related. The combination of a high current ratio and a low inventory turnover ratio, relative to industry norms, suggests that the firm has an above-average inventory level and/or that part of the inventory is obsolete or damaged.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The current ratio and inventory turnover ratios both help us measure the firm's liquidity. The current ratio measures the relationship of a firm's current assets to its current liabilities, while the inventory turnover ratio gives us an indication of how long it takes the firm to convert its inventory into cash.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Borrowing by using short-term notes payable and then using the proceeds to retire long-term debt is an example of "window dressing." Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase additional inventories is another example of "window

Dressing."

B) Borrowing on a long-term basis and using the proceeds to retire short-term debt would improve the current ratio and thus could be

Considered to be an example of "window dressing."

C) Offering discounts to customers who pay with cash rather than buy on credit and then using the funds that come in quicker to purchase

Additional inventories is an example of "window dressing."

D) Using some of the firm's cash to reduce long-term debt is an

Example of "window dressing."

E) "Window dressing" is any action that improves a firm's fundamental, long-run position and thus increases its intrinsic value.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Market value ratios provide management with an indication of how investors view the firm's past performance and especially its future prospects.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ziebart Corp.'s EBITDA last year was $390,000 (= EBIT + depreciation + amortization) , its interest charges were $9,500, it had to repay $26,000 of long-term debt, and it had to make a payment of $17,400 under a long- term lease. The firm had no amortization charges. What was the EBITDA coverage ratio?

A) 7.32

B) 7.70

C) 8.09

D) 8.49

E) 8.92

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

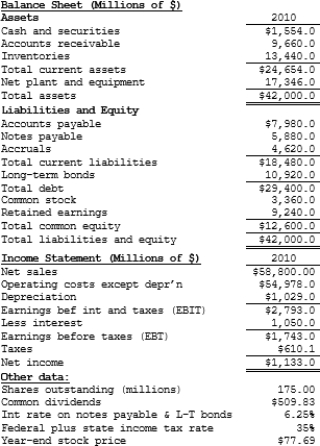

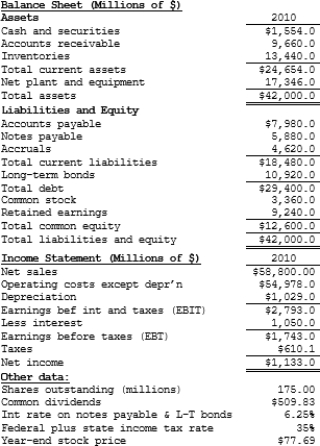

(The following data apply to Problems 87 through 105.)

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's BEP?

-What is the firm's BEP?

A) 6.00%

B) 6.32%

C) 6.65%

D) 6.98%

E) 7.33%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Firms A and B have the same amount of assets, pay the same interest rate on their debt, have the same basic earning power (BEP), and have the same tax rate. However, Firm A has a higher debt ratio. If BEP is greater than the interest rate on debt, Firm A will have a higher ROE as a result of its higher debt ratio.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The inventory turnover ratio and days sales outstanding (DSO) are two ratios that are used to assess how effectively a firm is managing its assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

(The following data apply to Problems 87 through 105.)

The balance sheet and income statement shown below are for Pettijohn Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over.

-What is the firm's dividends per share?

-What is the firm's dividends per share?

A) $2.62

B) $2.91

C) $3.20

D) $3.53

E) $3.88

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm wants to strengthen its financial position. Which of the following actions would increase its current ratio?

A) Reduce the company's days' sales outstanding to the industry average and use the resulting cash savings to purchase plant and

Equipment.

B) Use cash to repurchase some of the company's own stock.

C) Borrow using short-term debt and use the proceeds to repay debt

That has a maturity of more than one year.

D) Issue new stock and then use some of the proceeds to purchase

Additional inventory and hold the remainder as cash.

E) Use cash to increase inventory holdings.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would indicate an improvement in a company's financial position, holding other things constant?

A) The inventory and total assets turnover ratios both decline.

B) The debt ratio increases.

C) The profit margin declines.

D) The EBITDA coverage ratio declines.

E) The current and quick ratios both increase.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Companies HD and LD have the same tax rate, sales, total assets, and basic earning power. Both companies have positive net incomes. Company HD has a higher debt ratio and, therefore, a higher interest expense. Which of the following statements is CORRECT?

A) Company HD has a lower equity multiplier.

B) Company HD has more net income.

C) Company HD pays more in taxes.

D) Company HD has a lower ROE.

E) Company HD has a lower times interest earned (TIE) ratio.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Harper Corp.'s sales last year were $395,000, and its year-end receivables were $42,500. Harper sells on terms that call for customers to pay 30 days after the purchase, but many delay payment beyond Day 30. On average, how many days late do customers pay? Base your answer on this equation: DSO - Allowed credit period = Average days late, and use a 365-day year when calculating the DSO.

A) 7.95

B) 8.37

C) 8.81

D) 9.27

E) 9.74

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Altman Corp. had $205,000 of assets, $303,500 of sales, $18,250 of net income, and a debt-to-total-assets ratio of 41%. The new CFO believes the firm has excessive fixed assets and inventory that could be sold, enabling it to reduce its total assets to $152,500. Sales, costs, and net income would not be affected, and the firm would maintain the 41% debt ratio. By how much would the reduction in assets improve the ROE?

A) 4.69%

B) 4.93%

C) 5.19%

D) 5.45%

E) 5.73%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Debt management ratios show the extent to which a firm's managers are attempting to magnify returns on owners' capital through the use of financial leverage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Walter Industries' current ratio is 0.5. Considered alone, which of the following actions would increase the company's current ratio?

A) Borrow using short-term notes payable and use the cash to increase inventories.

B) Use cash to reduce accruals.

C) Use cash to reduce accounts payable.

D) Use cash to reduce short-term notes payable.

E) Use cash to reduce long-term bonds outstanding.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Amram Company's current ratio is 1.9. Considered alone, which of the following actions would reduce the company's current ratio?

A) Borrow using short-term notes payable and use the proceeds to reduce accruals.

B) Borrow using short-term notes payable and use the proceeds to

Reduce long-term debt.

C) Use cash to reduce accruals.

D) Use cash to reduce short-term notes payable.

E) Use cash to reduce accounts payable.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If one firm has a higher debt ratio than another, we can be certain that the firm with the higher debt ratio will have the lower TIE ratio, as that ratio depends entirely on the amount of debt a firm

Uses.

B) A firm's use of debt will have no effect on its profit margin on

Sales.

C) If two firms differ only in their use of debt-i.e., they have identical assets, sales, operating costs, interest rates on their debt, and tax rates-but one firm has a higher debt ratio, the firm

That uses more debt will have a lower profit margin on sales.

D) The debt ratio as it is generally calculated makes an adjustment for the use of assets leased under operating leases, so the debt ratios of firms that lease different percentages of their assets

Are still comparable.

E) If two firms differ only in their use of debt-i.e., they have identical assets, sales, operating costs, and tax rates-but one firm has a higher debt ratio, the firm that uses more debt will

Have a higher profit margin on sales.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 103

Related Exams