A) greater than 0.5 but less than 1.0 percent

B) greater than 1.0 percent but less than 2.5 percent

C) greater than 2.5 percent but less than 16 percent

D) greater than 84 percent but less than 97.5 percent

E) greater than 95 percent

G) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 3 percent, -10 percent, 24 percent, 22 percent, and 12 percent.Suppose the average inflation rate over this time period was 3.6 percent and the average T-bill rate was 4.8 percent.Based on this information, what was the average nominal risk premium?

A) 5.15 percent

B) 5.40 percent

C) 6.01 percent

D) 6.37 percent

E) 6.60 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What was the average rate of inflation over the period of 1926-2010?

A) less than 2.0 percent

B) between 2.0 and 2.5 percent

C) between 2.5 and 3.0 percent

D) between 3.0 and 3.5 percent

E) greater than 3.5 percent

G) A) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

A stock had returns of 12 percent, 16 percent, 10 percent, 19 percent, 15 percent, and -6 percent over the last six years.What is the geometric average return on the stock for this period?

A) 10.90 percent

B) 10.68 percent

C) 13.56 percent

D) 14.76 percent

E) 15.01 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You find a certain stock that had returns of 4 percent, -5 percent, -15 percent, and 16 percent for four of the last five years.The average return of the stock for the 5-year period was 13 percent.What is the standard deviation of the stock's returns for the five-year period?

A) 21.39 percent

B) 24.98 percent

C) 27.16 percent

D) 31.23 percent

E) 34.02 percent

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following is most indicative of a totally efficient stock market?

A) extraordinary returns earned on a routine basis

B) positive net present values on stock investments over the long-term

C) zero net present values for all stock investments

D) arbitrage opportunities which develop on a routine basis

E) realizing negative returns on a routine basis

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following correspond to a wide frequency distribution? I.relatively low risk II.relatively low rate of return III.relatively high standard deviation IV.relatively large risk premium

A) II only

B) III only

C) I and II only

D) II and III only

E) III and IV only

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You own 400 shares of Western Feed Mills stock valued at $51.20 per share.What is the dividend yield if your annual dividend income is $352?

A) 1.68 percent

B) 1.72 percent

C) 1.83 percent

D) 1.13 percent

E) 1.21 percent

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements are true based on the historical record for 1926-2010? I.Risk and potential reward are inversely related. II.Risk-free securities produce a positive real rate of return each year. III.Returns are more predictable over the short-term than they are over the long-term. IV.Bonds are generally a safer investment than are stocks.

A) I only

B) IV only

C) II and III only

D) II and IV only

E) II, III, and IV only

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements concerning U.S.Treasury bills is correct for the period 1926- 2010?

A) The annual rate of return always exceeded the annual inflation rate.

B) The average risk premium was 0.7 percent.

C) The annual rate of return was always positive.

D) The average excess return was 1.1 percent.

E) The average real rate of return was zero.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following earned the highest risk premium over the period 1926-2010?

A) long-term corporate bonds

B) U.S.Treasury bills

C) small-company stocks

D) large-company stocks

E) long-term government bonds

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Over a 30-year period an asset had an arithmetic return of 13 percent and a geometric return of 10.5 percent.Using Blume's formula, what is your best estimate of the future annual returns over the next 5 years?

A) 11.18 percent

B) 12.27 percent

C) 11.84 percent

D) 12.66 percent

E) 12.46 percent

G) A) and B)

Correct Answer

verified

Correct Answer

verified

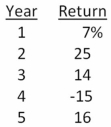

Multiple Choice

Calculate the standard deviation of the following rates of return:

A) 10.79 percent

B) 12.60 percent

C) 13.48 percent

D) 14.42 percent

E) 15.08 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The return earned in an average year over a multi-year period is called the _____ average return.

A) arithmetic

B) standard

C) variant

D) geometric

E) real

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements is correct?

A) The greater the volatility of returns, the greater the risk premium.

B) The lower the volatility of returns, the greater the risk premium.

C) The lower the average return, the greater the risk premium.

D) The risk premium is unrelated to the average rate of return.

E) The risk premium is not affected by the volatility of returns.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the variability of the returns on large-company stocks were to increase over the long-term, you would expect which of the following to occur as a result? I.decrease in the average rate of return II.increase in the risk premium III.increase in the 68 percent probability range of the frequency distribution of returns IV.decrease in the standard deviation

A) I only

B) IV only

C) II and III only

D) I and III only

E) II and IV only

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As long as the inflation rate is positive, the real rate of return on a security will be ____ the nominal rate of return.

A) greater than

B) equal to

C) less than

D) greater than or equal to

E) unrelated to

G) B) and E)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

A stock had returns of 16 percent, 4 percent, 8 percent, 14 percent, -9 percent, and -5 percent over the past six years.What is the geometric average return for this time period?

A) 4.26 percent

B) 4.67 percent

C) 5.13 percent

D) 5.39 percent

E) 5.60 percent

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose a stock had an initial price of $80 per share, paid a dividend of $1.35 per share during the year, and had an ending share price of $87.What was the capital gains yield?

A) 1.55 percent

B) 1.69 percent

C) 8.05 percent

D) 8.75 percent

E) 10.44 percent

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume that you invest in a portfolio of large-company stocks.Further assume that the portfolio will earn a rate of return similar to the average return on large-company stocks for the period 1926-2010.What rate of return should you expect to earn?

A) less than 10 percent

B) between 10 and 12.5 percent

C) between 12.5 and 15 percent

D) between 15 and 17.5 percent

E) more than 17.5 percent

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 97

Related Exams