A) 14.3%

B) 15.0%

C) 13.1%

D) 12.7%

E) 10.3%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A firm cannot change its beta through any managerial decision because betas are completely market determined.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

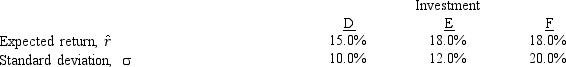

Based on the information given below, which of the following statements is incorrect?

A) Based on both risk and return, Investment D and Investment E should be considered equally risky.

B) If Investment F is negatively related to both Investment D and Investment E, then combining Investment F with both Investment D and Investment E would always produce a portfolio with lower risk than a portfolio of Investment F and either one of the other investments combined.

C) Investment F is the most desirable security for investors who are risk averse and who want to hold a one-security portfolio.

D) An investor can purchase positive amounts of Investment D and Investment F and form a two-security portfolio with a return greater than 18 percent and a standard deviation less than 10 percent.

E) None of the above statements is correct.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Combining shares with perfectly correlated shares returns into a portfolio is less risky than holding an individual share since the portfolio will benefit from diversification.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The tighter the probability distribution, the less variability there is and the less likely it is that the actual outcome will be close to the expected value; consequently the more likely it is that the actual return will be much different from the expected return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is most correct?

A) An increase in expected inflation could be expected to increase the required return on a riskless asset and on an average share by the same amount, other things held constant.

B) A graph of the SML would show required rates of return on the vertical axis and standard deviations of returns on the horizontal axis.

C) If two "normal" or "typical" shares were combined to form a 2-share portfolio, the portfolio's expected return would be a weighted average of the shares' expected returns, but the portfolio's standard deviation would probably be greater than the average of the shares' standard deviations.

D) If investors became more averse to risk, then (1) the slope of the SML would increase and (2) the required rate of return on low-beta shares would increase by more than the required return on high-beta shares.

E) The CAPM has been thoroughly tested, and the theory has been confirmed beyond any reasonable doubt.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

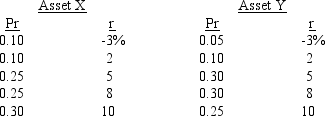

Multiple Choice

Assume that a new law is passed which restricts investors to holding only one asset.A risk-averse investor is considering two possible assets as the asset to be held in isolation.The assets' possible returns and related probabilities (i.e., the probability distributions) are as follows:  Which asset should be preferred?

Which asset should be preferred?

A) Asset X, since its expected return is higher.

B) Asset Y, since its beta is probably lower.

C) Either one, since the expected returns are the same.

D) Asset X, since its standard deviation is lower.

E) Asset Y, since its coefficient of variation is lower and its expected return is higher.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Assume Share A has a standard deviation of 0.21 while Share B has a standard deviation of 0.10.If both Share A and Share B must be held in isolation, and if investors are risk averse, we can conclude that Share A will have a greater required return.However, if the assets could be held in portfolios, it is conceivable that the required return could be higher on the low standard deviation stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume you are considering combining two investments to form a portfolio and you are very concerned with the risk that will result from the combination.If you want to attain the greatest effect from diversification, you would prefer that the assets are __________ related.

A) negatively

B) positively

C) not

D) The relationship between the two investments gives no indication of the diversification effect that will result by combining them to form a portfolio.

E) Diversification is not an important factor in investment decisions.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Risk really should not be a significant factor when making financial decision because all business decisions involve predictions about the future, which is unknown.As a result, all decisions automatically include some consideration of risk.

B) False

Correct Answer

verified

Correct Answer

verified

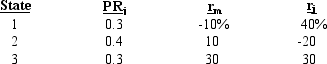

Multiple Choice

Given the following probability distributions, what are the expected returns for the Market and for Security J?

A) 10.0%; 11.3%

B) 9.5%; 13.0%

C) 10.0%; 9.5%

D) 10.0%; 13.0%

E) 13.0%; 10.0%

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Oakdale Furniture Inc.has a beta coefficient of 0.7 and a required rate of return of 15 percent.The market risk premium is currently 5 percent.If the inflation premium increases by 2 percentage points, and Oakdale acquires new assets which increase its beta by 50 percent, what will be Oakdale's new required rate of return?

A) 13.5%

B) 22.8%

C) 18.75%

D) 15.25%

E) 17.00%

G) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Because of differences in the expected returns of different securities, the standard deviation is not always an adequate measure of risk.However, the coefficient of variation always will allow an investor to properly compare the relative risks of any two securities.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If we develop a weighted average of the possible return outcomes, multiplying each outcome or "state" by its respective probability of occurrence for a particular share, we can construct a payoff matrix of expected returns.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Share X has ( ) . = 4.0, which means that it is considered four times riskier than the average share, or the share market as a whole.According to the capital asset pricing model, Share X should earn

A) a total return that is four times greater than the market return, that is, rX = 4 * rM.

B) a risk premium that is four times greater than the market risk premium-that is, RPX = 4 * RPM, which means that rX B kRF = 4 * (rM B kRF) .

C) a return that is less than the market return (rM) because, all else equal, the high risk associated with Share X will cause its value to decrease.

D) the risk-free rate of return (rRF) .

E) None of the above is correct.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Share Q has a beta ( ) .) equal to 1.6 and Share P has a beta equal to 0.8.Based on this information, according to the capital asset pricing model (CAPM) , which of the following statements is correct?

A) The required rate of return for Share Q, rQ, should be 1.6 times greater than the required rate of return for Share P, rP.

B) The risk premium associated with Share Q, RPQ, should be 1.6 times greater than the risk premium associated with Share P, RPP.

C) The required rate of return for Share Q, rQ, should be two times greater than the required rate of return for Share P, rP.

D) The risk premium associated with Share Q, RPQ, should be two times greater than the risk premium associated with Share P, RPP.

E) None of the above is a correct answer.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A listing of all possible outcomes, or events, with a probability assigned to each is called a probability distribution.

B) False

Correct Answer

verified

Correct Answer

verified

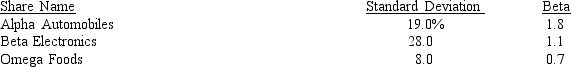

Multiple Choice

According to the capital asset pricing model, which of the following shares should have the highest required rate of return?

A) Beta Electronics because its standard deviation is highest.

B) Alpha Automobiles because its beta coefficient is highest.

C) Omega foods because the ration of standard deviation/beta is the lowest.

D) Not enough information is given to answer this question.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The expected rate of return of an asset will always equal one of the possible rates of return for that asset.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

HR Corporation has a beta of 2.0, while LR Corporation's beta is 0.5.The risk-free rate is 10%, and the required rate of return on an average share is 15%.Now the expected rate of inflation built into kRF falls by 3 percentage points, the real risk-free rate remains constant, the required return on the market falls to 11%, and the betas remain constant.When all of these changes are made, what will be the difference in required returns on HR's and LR's shares?

A) 1.0%

B) 2.5%

C) 4.5%

D) 5.4%

E) 6.0%

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 67

Related Exams