A) Federal Reserve Act of 1913.

B) Employment Act of 1946.

C) tax increase of 1968.

D) wage and price controls of 1971.

E) tax cut of 1981.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

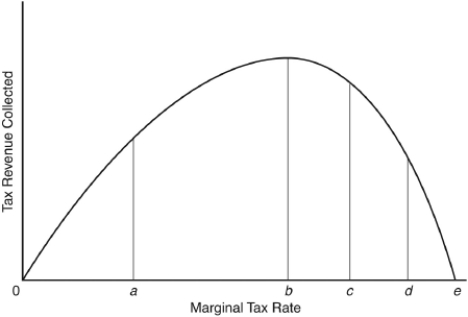

The following question are based on the following Laffer curve:

-According to this curve,tax revenue is maximized when the tax rate is

-According to this curve,tax revenue is maximized when the tax rate is

A) 0a.

B) 0b.

C) 0c.

D) 0e.

E) 0d.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate of real per capita GDP growth in the United States

A) has consistently exceeded that of every other major nation except Japan.

B) steadily increased by 4 percent during each decade from 1870 to 1970.

C) has not been affected by changes in labor force productivity.

D) has averaged about 2 percent per year over the last century.

E) has averaged in excess of 5 percent per year in the decades since World War II.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

By 2009 U.S.expenditures on research and development

A) averaged about 10 percent of the GDP.

B) fell well below the levels of the 1960s.

C) were over 11 times what they were in 1953.

D) consistently led those of other developed nations in all fields.

E) have been directed primarily to making major advances in civilian technology.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be the most effective public policy for encouraging research and development?

A) subsidizing industries that are at a competitive disadvantage

B) maintaining price stability and encouraging saving and investment

C) increasing interest rates to make investment more profitable

D) reducing resource mobility to ensure an adequate labor supply

E) increasing the scope and extent of industrial regulation

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Inflationary pressures may be lessened with measures designed to

A) shift the aggregate demand curve to the right.

B) shift the aggregate supply curve to the right.

C) shift the Phillips curve to the right.

D) couple a leftward shift in the aggregate supply curve with a rightward shift in the aggregate demand curve.

E) make the aggregate supply curve vertical at a lower level of real output.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

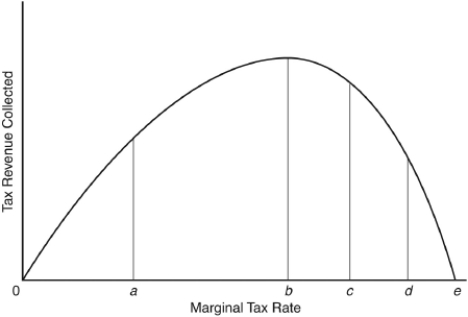

The following question are based on the following Laffer curve:

-Advocates of supply-side tax reductions,such as a reduction in the capital gains tax,argue that these taxes currently have marginal tax rates that are

-Advocates of supply-side tax reductions,such as a reduction in the capital gains tax,argue that these taxes currently have marginal tax rates that are

A) 0.

B) to the left of 0a.

C) between 0a and 0b.

D) to the right of 0b.

E) greater than 0e.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Critics of supply-side economic theory argue that the tax cut of 1981

A) shifted the aggregate supply curve to the left.

B) shifted the aggregate demand curve to the left.

C) caused the price level to rise with no change in real GDP.

D) led mainly to dramatic increases in the money supply.

E) did not increase the percent of total income devoted to saving.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The argument that the primary impact of the 1981 tax cut was on aggregate demand is based on the fact that

A) output did not rise sufficiently to offset the effect of the tax cuts on the size of the federal deficit.

B) unemployment rose significantly after the tax cut, necessitating increased federal welfare.

C) after the tax cut, the velocity of circulation of the money supply rose at a rapid rate.

D) the inflationary pressures in the economy after the tax cut were greater than the pre-tax cut rate of inflation.

E) the United States ran a balance of payments surplus for the first time in the post-Vietnam War era two years after the tax cut.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The deep recessions experienced in many fast-growing East Asian economies in 1997-98

A) were unexpected by virtually all economists who had been studying the "Asian miracle."

B) produced a significant shortage in overall global capacity.

C) led to a continuing and deepening condition of economic stagnation over the entire region.

D) demonstrated that it is extremely unlikely that sustained economic growth can be accomplished in developing countries.

E) were a direct result of the Asian financial crisis.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the video,Edwin Mansfield notes that one reason why R&D spending by firms has declined as a percent of national output is that

A) very little is left to invent, since research was so great in the first half of the twentieth century.

B) most research goes to enhance military spending, which is no longer as important as it once was.

C) a firm cannot appropriate all the benefits it creates from R&D, because they spill over to outsiders, so it tends to underinvest in this area.

D) R&D rarely results in marketable products, so increasingly it is being performed in government research facilities.

E) stagflation has made R&D unprofitable for the smaller firms that carry out the largest share of this activity.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supply-side government policies emphasize measures to

A) increase total real output while reducing the price level.

B) shift aggregate demand to the classical range of the supply curve.

C) shift the aggregate supply curve to the left.

D) increase taxes to finance increased government expenditures on public works projects such as highways and mass transit.

E) supplement increased government spending with increased consumer spending on goods and services.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Among the reasons cited for the productivity slowdown in our society is the

A) increased rate of incorporating new technology in capital equipment.

B) change in the composition of both the labor force and national output.

C) increased rate of growth of the capital-labor ratio.

D) devotion of too great a share of our resources to research and development.

E) increase of resource mobility and competitiveness in our market economy.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the Stagflation video,economist Laffer argued that

A) a penny saved is a penny earned.

B) people do not work to pay taxes.

C) demand creates its own supply.

D) output per worker is a poor measure of productivity.

E) expected rates of return on R&D are positively correlated with the rate of inflation.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Excluded from the four key trends that account for the high Asian growth rates in the 1980s and early 1990s are

A) rising female labor force participation rates.

B) rapid rises in educational attainment.

C) rapid increases in the rate of innovation and a growth in Asian consumer demand.

D) high and rising investment rates.

E) shifts of workers from agriculture to manufacturing.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Supply-side measures pushed through Congress by the Reagan administration include

A) proposals to decrease the money supply.

B) changes limiting the protection afforded by our patent laws.

C) a 25 percent cut in the personal income tax and accelerated depreciation of plant and equipment.

D) "comparable worth" laws to ensure equal pay.

E) laws limiting the rate of interest that may be charged on loans for investment purposes.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A more rapid rate of growth of productivity can be achieved if

A) the rate of investment in equipment increases.

B) a country's population growth rate rises rapidly, increasing demand.

C) high rates of inflation are maintained.

D) government involvement is eliminated.

E) private saving is discouraged.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major U.S.tax bill that contained a provision for an incremental tax credit for research and development was passed in

A) 1981.

B) 1979.

C) 1974.

D) 1967.

E) 1963.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to supply-side economists,noninflationary policies to expand real GDP involve

A) decreasing the rate of growth of the money supply to lower interest rates.

B) reducing the tax burden.

C) increasing welfare and other government income support programs.

D) policies to make the aggregate supply curve vertical.

E) the use of wage and price controls.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists are concerned about a slowdown in productivity because of the risk of higher inflation rates and a(n)

A) loss of our ability to diversify in manufacturing.

B) increased dependence on imported raw materials.

C) decline in service industries that depend on microelectronics technology.

D) potential decline in technological change that could affect our future rate of growth.

E) fear that it will lead to an influx of unskilled workers replacing domestic workers.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 58

Related Exams