A) change the tax laws so that all of the social security tax was imposed on firms.

B) change the tax laws so that all of the social security tax was imposed on workers.

C) change the tax laws so that more than 50 percent of the social security tax was imposed on firms.

D) change the tax laws so that more than 50 percent of the social security tax was imposed on workers.

E) None of the above because the incidence of the social security tax does not depend on the tax laws but instead depends on the elasticities of the demand for labor and the supply of labor.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

From the standpoint of efficiency, imposing a tax on the income from what type of resource is best because it creates the least inefficiency?

A) a resource with a perfectly elastic supply

B) a resource with a perfectly elastic demand

C) a resource that earns a high reward

D) a resource with a fixed supply

E) a resource that earns a low reward.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the supply of apartments in Minneapolis is perfectly elastic.The effect of a $100 per month tax on all apartments is that

A) landlords pay none of the tax and there is a surplus of apartments.

B) landlords pay all of the tax and suffer all of the deadweight loss.

C) landlords pay all of the tax and no changes take place in the quantity of apartments supplied.

D) renters pay all of the tax.

E) the government collects no tax revenue because the supply is perfectly elastic.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A tax on income from land in Montana is borne entirely by landowners because the

A) demand for land is perfectly inelastic.

B) supply of land is perfectly inelastic.

C) supply of land is perfectly elastic.

D) demand for land is perfectly elastic.

E) deadweight loss from the tax would otherwise be infinite.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the supply of capital is perfectly elastic, the incidence of a tax on capital income is

A) paid entirely by the suppliers of capital.

B) paid entirely by firms that demand capital.

C) shared equally between firms that demand capital and the suppliers of capital.

D) shared but not equally between firms that demand capital and the suppliers of capital.

E) unknown.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The proposition that people should pay taxes equal to the benefits they receive from public services is known as the

A) ability-to-pay principle.

B) progressive tax principle.

C) fairness principle.

D) benefits principle.

E) "he or she who gets, pays" principle.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $2.00 increase in the size of a tax on a good will only cause the price for buyers to increase by $2.00 if

A) demand is perfectly inelastic.

B) demand is perfectly elastic.

C) demand is unit elastic.

D) demand is inelastic, but not perfectly inelastic.

E) demand is elastic, but not perfectly elastic.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If highly paid entertainers prefer to perform and would do so even if their pay were much lower, a tax of half of the entertainers' incomes would do which of the following?

A) decrease the amount of entertaining done by moving along a given labor supply curve

B) decrease the entertainers' supply of performances

C) collect no taxes at all

D) not change the quantity supplied of performances

E) increase the entertainers' supply of performances as they work more to make up the income they lose in taxes

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

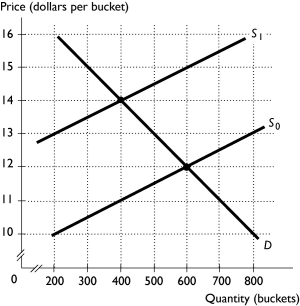

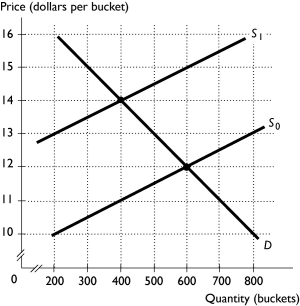

-The above figure shows the market for buckets of golf balls at the driving range.A new leisure time tax is placed on suppliers in this market, shifting the supply curve from S₀ to S₁.The quantity of buckets without the tax is ________ and the quantity with the tax is ________.

-The above figure shows the market for buckets of golf balls at the driving range.A new leisure time tax is placed on suppliers in this market, shifting the supply curve from S₀ to S₁.The quantity of buckets without the tax is ________ and the quantity with the tax is ________.

A) 400; 600

B) 600; 400

C) 400; 400

D) 800; 500

E) 600; 500

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

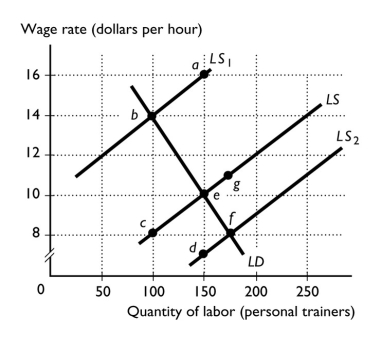

-The figure above shows the labor supply and labor demand curves for personal trainers in the state of Florida.The initial equilibrium hourly wage is $10.Suppose the state of Florida institutes an income tax on labor income of $6 an hour in order to buy voting machines for the next election.With the tax in place, the labor supply curve will

-The figure above shows the labor supply and labor demand curves for personal trainers in the state of Florida.The initial equilibrium hourly wage is $10.Suppose the state of Florida institutes an income tax on labor income of $6 an hour in order to buy voting machines for the next election.With the tax in place, the labor supply curve will

A) remain at LS.

B) shift to LS₁.

C) shift to LS₂.

D) change so that it becomes the same as LD.

E) None of the above answers is correct.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The phrase "tax incidence" refers to

A) how easy it is to evade the tax.

B) how taxes redistribute income.

C) the degree of progressiveness or regressiveness of the tax.

D) who actually bears the burden of paying the tax.

E) how much the government collects in revenue from a tax.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

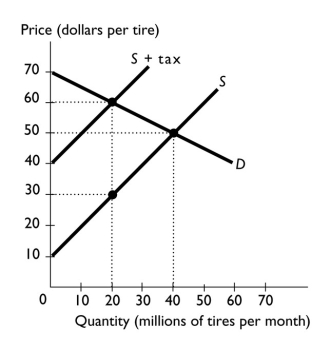

-The figure above shows the market for tires.The government has imposed a tax on tires, and the buyers pay ________ of the tax.

-The figure above shows the market for tires.The government has imposed a tax on tires, and the buyers pay ________ of the tax.

A) $10

B) $20

C) $50

D) $60

E) $30

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ tax rate equals ________.

A) A marginal; the percentage of total income that is paid in tax

B) A progressive; the percentage of an additional dollar of income that is paid in tax

C) An average; the percentage of total income that is paid in tax

D) A regressive; the percentage of an additional dollar of income that is paid in tax

E) A proportional; the percentage of total income that is paid in tax

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Because the supply of land is perfectly inelastic, when governments tax land, the tax

A) creates a deadweight loss because the supply is fixed.

B) decreases both the demand for and the supply of land.

C) creates no deadweight loss because the equilibrium quantity is the same as without the tax.

D) increases the supply of land because the landlord pays all of the tax.

E) decreases the supply of land because the landlord pays all of the tax.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

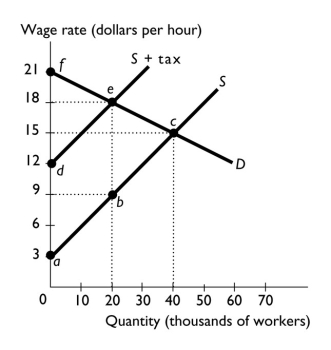

-The figure above shows the impact of an income tax.The deadweight loss created by the income tax equals area

-The figure above shows the impact of an income tax.The deadweight loss created by the income tax equals area

A) bce.

B) fed.

C) acf.

D) feba.

E) The question errs because an income tax does not create a deadweight loss.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taxes on corporate profit are a type of ________ tax.

A) sales

B) property

C) income

D) regressive

E) selling

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A sales tax imposed on sellers of a good

A) decreases the demand and shifts the demand curve rightward.

B) decreases the supply and shifts the supply curve leftward.

C) decreases both the demand and the supply and shifts both the demand and supply curves leftward.

D) decreases the supply and shifts the supply curve rightward.

E) has no effect on either the demand or the supply.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

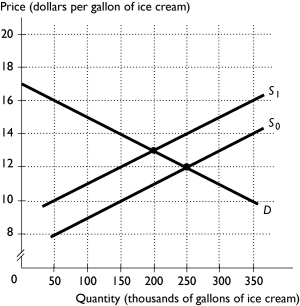

-The above figure shows the market for gourmet ice cream.In effort to reduce obesity, government places a $2 tax per gallon on suppliers in this market, shifting the supply curve from S₀ to S₁.The quantity of ice cream consumed before the tax is ________ gallons and the quantity consumed after the tax is ________ gallons.

-The above figure shows the market for gourmet ice cream.In effort to reduce obesity, government places a $2 tax per gallon on suppliers in this market, shifting the supply curve from S₀ to S₁.The quantity of ice cream consumed before the tax is ________ gallons and the quantity consumed after the tax is ________ gallons.

A) 300,000; 200,000

B) 200,000; 250,000

C) 250,000; 200,000

D) 200,000; 300,000

E) 200,000; 200,000

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The size of the deadweight loss, or excess burden, of a tax depends on the

A) amount of producer surplus but not the amount of consumer surplus because it is the producers who send the tax revenues to the government.

B) strength of demand.

C) strength of supply.

D) elasticities of demand and supply.

E) number of demanders and the number of suppliers.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

-The above figure shows the market for buckets of golf balls at the driving range.A new leisure time tax is placed on suppliers in this market, shifting the supply curve from S₀ to S₁.The total tax revenue is equal to

-The above figure shows the market for buckets of golf balls at the driving range.A new leisure time tax is placed on suppliers in this market, shifting the supply curve from S₀ to S₁.The total tax revenue is equal to

A) $1,800.

B) $600.

C) $1,200.

D) $900.

E) $5,600.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 267

Related Exams