A) farmers.

B) an elderly couple recently retired to Yuma, Arizona.

C) Apple Computer.

D) a typical consumer of the market basket used to calculate the index.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would benefit financially from unanticipated inflation?

A) a borrower whose loan has a fixed nominal interest rate

B) a borrower with an adjustable rate mortgage

C) a bank that has made loans at a fixed nominal interest rate

D) a firm whose workers are covered by a COLA agreement

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Historically, the United States has experienced

A) continuous decreases in the unemployment rate since World War II.

B) periods of both increases and decreases in the unemployment rate since World War II.

C) continuous increases in the unemployment rate since World War II.

D) no changes in the unemployment rate since World War II.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The seasonally adjusted unemployment rate

A) reports only seasonal unemployment.

B) removes the seasonal variation from the unemployment rate.

C) is impossible to compute since no one knows what the seasonal component equals.

D) is another name for structural unemployment.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following best fits the definition of unemployed?

A) retired and not working

B) working less than a full work week

C) not working but looking for a job

D) not working at a gainful pursuit, either in or out of the home

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Unanticipated inflation occurs when

A) everyone knows perfectly the true rate of inflation.

B) the actual inflation rate differs from the anticipated inflation rate.

C) the inflation rate is zero.

D) there is no change in the purchasing power of money.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The rate of unemployment is calculated as the number of

A) unemployed workers divided by the number of employed workers.

B) people in the civilian labor force divided by the number of unemployed.

C) unemployed divided by the number of people in the civilian labor force.

D) employed workers divided by the number of unemployed workers.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

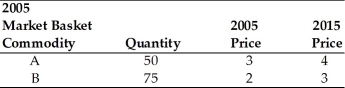

-Refer to the above table. You are given information on Jasmin's consumption for 2005 and 2015. Using 2005 as the base year, compute the price index for 2015. The index equals

-Refer to the above table. You are given information on Jasmin's consumption for 2005 and 2015. Using 2005 as the base year, compute the price index for 2015. The index equals

A) 1.5.

B) 70.588.

C) 141.667.

D) 107.143.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are examples of a flow EXCEPT

A) a new entrant into the labor force.

B) an individual who voluntarily leaves the labor force.

C) a person who is fired from a job.

D) the current unemployment rate.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major element of the concepts of inflation and deflation is

A) the idea that price changes are measured daily.

B) their dependence on average rather than individual prices.

C) the requirement that ALL prices must be moving in the same direction.

D) each household's willingness to report what they pay for goods and services each month.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

An individual in the labor force whose employment was involuntarily terminated is

A) a job leaver.

B) a job loser.

C) a job reentrant.

D) part of the PPI.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The purpose of COLAs is to protect

A) lenders.

B) borrowers.

C) workers.

D) businesses.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Who stands to gain as a result of unanticipated inflation?

A) creditors

B) debtors

C) persons living on a fixed income

D) retired individuals

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a TRUE statement?

A) All recessions are due to external shocks.

B) Ultimately, no recession has been due to an external shock.

C) There have been recessions that cannot be explained by external shocks.

D) All recessions and all expansions are due to external shocks.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

During a recession

A) incomes rise and employment decreases.

B) incomes fall and unemployment increases.

C) incomes fall and unemployment falls.

D) incomes rise and unemployment increases.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A recent accounting graduate from a major business school is searching for a place to begin his career as an accountant. This individual is

A) structurally unemployed.

B) seasonally unemployed.

C) cyclically unemployed.

D) frictionally unemployed.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Historically speaking, business fluctuations in an economy were more commonly referred to as

A) inflationary pressures.

B) economic growth.

C) the GDP deflator.

D) business cycles.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

New entrants to the labor force usually account for around ________ percent of the unemployed.

A) ten

B) twenty

C) twenty-five

D) thirty

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If all prices in the economy go up from one year to the next, the CPI index, using the previous year as the base would

A) be less than 100.

B) be greater than 100.

C) not be influenced since quantities have remained unchanged.

D) not be determined since enough information is given.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Full employment in the United States today

A) means a 100% employment rate.

B) means 0% unemployment for 6 months.

C) means about a 95% employment rate.

D) means that the cyclical unemployment rate is about 5%.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 412

Related Exams