A) investors don't want to take on any risk.

B) investors would usually prefer investments with high standard deviations and a greater opportunity for gain.

C) that the greater the risk, the lower the expected return must be.

D) that for a given situation, investors would prefer relative certainty to uncertainty, and the greater the risk, the higher the expected return must be.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

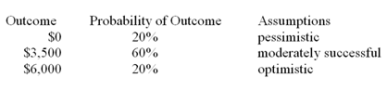

Modigliani and Associates has forecasted the following payoffs from a project:  What is the expected value of the outcomes?

What is the expected value of the outcomes?

A) $0

B) $3,300

C) $3,700

D) Cannot be determined. Depends upon which prediction is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The higher the risk of an investment, the lower the required rate of return by investors. The higher the risk, the higher the consequent required rate of return.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

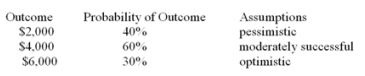

Buchanan Corp. forecasts the following payoffs from a project:  What is the expected value of the outcomes?

What is the expected value of the outcomes?

A) $5,000

B) $4,000

C) $5,300

D) The forecast is incorrect and must be modified before finding the expected value.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If possible outcomes are D and probabilities are P, the standard deviation is defined as

B) False

Correct Answer

verified

Correct Answer

verified

True/False

As the time horizon becomes shorter, more uncertainty enters the forecast. The level of uncertainty increases with time.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Combining assets with highly correlated returns will greatly reduce portfolio risk. Just the opposite: Negative correlation spreads risk more effectively.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Sensitivity analysis helps the financial planner determine how sensitive shareholders will be to changes in investment strategy.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a characteristic of beta?

A) Beta measures only the volatility of returns on an individual bond relative to a bond market index.

B) A beta of 1.0 has zero risk.

C) A beta of less than 1.0 has less risk than the market.

D) A beta is always equal to 1.0.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The firm's highest risk-adjusted discount should be applied to

A) the repair of old machinery.

B) a new product in a related field.

C) a new product in a foreign market.

D) the purchase of new equipment

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Cyclical businesses are likely to have higher costs of capital than firms with less variability in earnings. Therefore, more cyclical firms should typically use a higher discount rate in project evaluation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In determining the appropriate discount rate for an individual project, the financial manager will be most influenced by the

A) expected value.

B) internal rate of return.

C) standard deviation.

D) coefficient of variation.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The coefficient of correlation represents the standard deviation divided by the expected value. This is actually the definition of the "coefficient of variation."

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a common approach in dealing with uncertainty?

A) A Monte Carlo simulation

B) An internal rate of return

C) The net present value

D) Beta

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cost of capital is assumed to contain no risk for the firm. As noted in earlier chapters, the cost of capital begins with a risk-free rate, but is then adjusted for inflation risk and business risk.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An investment with a $500 standard deviation and a $5,000 expected value has a higher risk than an investment with a $4,000 standard deviation and a $50,000 expected value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A correlation coefficient of zero indicates

A) the projects have the same expected value.

B) there is no correlation and no risk reduction when the projects are combined.

C) there is no correlation, but there is some risk reduction when the projects are combined.

D) the projects have the same standard deviation.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The measure of risk is best described as

A) potential loss.

B) the variability of outcomes around some expected value.

C) the probability of expected values.

D) the potential expected loss.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A project's cash flows have a beta of 1.2, a standard deviation of $340, and a coefficient of variation of 0.40. What is the expected cash flow?

A) $850

B) $167

C) $2,400

D) $500

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

When choosing portfolios of assets, management should try to achieve the highest possible return at a given level of risk.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 85

Related Exams