A) $5.66

B) $6.09

C) $6.53

D) $7.50

E) $7.75

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

PayDay Loans is offering a special on one-year loans.The company will loan you $5,000 today in exchange for one payment of $5,900 one year from now.What is the APR on this loan?

A) 10.63 percent

B) 11.20 percent

C) 11.63 percent

D) 17.93 percent

E) 18.00 percent

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Popeye's Fried Chicken just took out an 8 percent interest-only loan of $50,000 for three years.Payments are to be made at the end of each year.What is the amount of the payment that will be due at the end of year 3?

A) $19,052.58

B) $20,166.67

C) $50,000.00

D) $54,000.00

E) $61,824.60

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your aunt loaned you money at 1.00 percent interest per month.What is the APR of this loan?

A) 11.88 percent

B) 12.00 percent

C) 12.16 percent

D) 16.00 percent

E) 16.28 percent

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Radio Shack offers credit to its customers and charges interest of 1.2 percent per month.What is the annual percentage rate?

A) 14.40 percent

B) 14.61 percent

C) 15.10 percent

D) 15.31 percent

E) 15.53 percent

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A loan has an APR of 8.5 percent and an EAR of 8.5 percent.Given this,the loan must:

A) have a one-year term.

B) have a zero percent interest rate.

C) charge interest annually.

D) must be an interest-only loan.

E) require the accrued interest be paid in full with each monthly payment.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to buy a new sports car from Roy's Cars for $51,800.The contract is in the form of a 48-month annuity due at a 9.2 percent APR.What will your monthly payment be?

A) $1,284.13

B) $1,309.29

C) $1,345.70

D) $1,352.98

E) $1,384.32

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Taylor Farms is borrowing $75,000 for three years at an APR of 9 percent.The loan calls for the principal balance to be reduced by equal amounts over the life of the loan.Interest is to be paid in full each year.The payments are to be made annually at the end of each year.How much will Taylor Farms pay in interest over the life of this loan?

A) $12,311.67

B) $12,484.90

C) $12,840.00

D) $13,500.00

E) $13,887.32

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

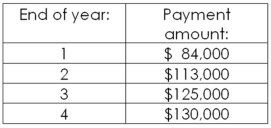

Slaughter Industries just signed a sales contract with a new customer.What is this contract worth as of the end of year 4 if the following payments will be received and the firm earns 6 percent on its savings?

A) $397,425.35

B) $402,311.19

C) $466,118.00

D) $485,271.13

E) $489,512.14

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jake owes $3,400 on his credit card.He is not charging any additional purchases because he wants to get this debt paid in full.The card has an APR of 13.9 percent.How much longer will it take him to pay off this balance if he makes monthly payments of $50 rather than $60?

A) 28.24 months

B) 31.33 months

C) 36.74 months

D) 39.20 months

E) 41.79 months

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the end of this month,Les will start saving $150 a month for retirement through his company's retirement plan.His employer will contribute an additional $0.50 for every $1.00 that he saves.If he is employed by this firm for 30 more years and earns an average of 10.5 percent on his retirement savings,how much will Les have in his retirement account 30 years from now?

A) $389,406.19

B) $401,005.25

C) $540,311.67

D) $566,190.22

E) $603,289.01

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following can be classified as an annuity but not as a perpetuity?

A) Increasing monthly payments forever

B) Increasing quarterly payments for six years

C) Unequal payments each year for nine years

D) Equal annual payments for life

E) Equal weekly payments forever

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Given an interest rate of 5.85 percent per year,what is the value at year t = 8 of a perpetual stream of $2,500 payments that begin at year t = 25?

A) $16,412.02

B) $17,208.00

C) $34,335.96

D) $36,235.06

E) $36,711.41

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You will receive annual payments of $2,400 at the end of each year for 15 years.The first payment will be received in year 6.What is the present value of these payments if the discount rate is 7 percent?

A) $11,465.20

B) $12,018.52

C) $13,299.80

D) $15,585.16

E) $16,856.60

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Billingsley,Inc.is borrowing $60,000 for five years at an APR of 8 percent.The principal is to be repaid in equal annual payments over the life of the loan with interest paid annually.Payments will be made at the end of each year.What is the total payment due for year 3 of this loan?

A) $13,920

B) $14,880

C) $15,220

D) $15,840

E) $16,800

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sticks and Stuff Furniture is offering a bedroom suite for $3,000.The credit terms are 60 months at $50 per month.What is the interest rate on this offer?

A) 0.00 percent

B) 1.50 percent

C) 1.65 percent

D) 1.15 percent

E) 1.30 percent

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following statements concerning annuities is correct?

A) The present value of an annuity is equal to the cash flow amount divided by the discount rate.

B) An annuity due has payments that occur at the beginning of each time period.

C) The future value of an annuity decreases as the interest rate increases.

D) If unspecified, you should assume an annuity is an annuity due.

E) An annuity is an unending stream of equal payments occurring at equal intervals of time.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kurt wants to have $25,000 in an investment account four years from now.The account will pay 0.2 percent interest per month.If he saves money every month,starting one month from now,how much will he have to save each month to reach his goal?

A) $496.75

B) $497.03

C) $497.75

D) $501.03

E) $502.14

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are comparing two annuities.Annuity A pays $100 at the end of each month for 10 years.Annuity B pays $100 at the beginning of each month for 10 years.The rate of return on both annuities is 8 percent.Which one of the following statements is correct given this information?

A) The present value of Annuity A is equal to the present value of Annuity B.

B) Annuity B will pay one more payment than Annuity A will.

C) The future value of Annuity A is greater than the future value of Annuity B.

D) Annuity B has both a higher present value and a higher future value than Annuity A.

E) Annuity A has a higher future value but a lower present value than Annuity B.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Anna pays 1.5 percent interest monthly on her credit card account.When the interest rate on that debt is expressed as if it were compounded only annually,the rate would be referred to as the:

A) annual percentage rate.

B) compounded rate.

C) quoted rate.

D) stated rate.

E) effective annual rate.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 123

Related Exams