A) fire managers who are inefficient

B) remove management's perquisites

C) tie management compensation to the performance of the company's common stock price

D) tie management compensation to the level of dividend per share

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The board of directors is responsible for managing day-to-day operations and carrying out the policies established by the chief executive officer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A sole proprietor has unlimited liability; his or her total investment in a business,but not his or her personal assets,can be taken to satisfy creditors.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following activities of a finance manager determines how the firm raises money to pay for the assets in which it invests?

A) financial analysis and planning

B) investment decisions

C) financing decisions

D) analyzing and planning cash flows

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The board of directors is typically responsible for ________.

A) approving strategic goals and plans

B) managing day-to-day operations

C) arranging finance for approved long-term investments

D) maintaining and controlling the firm's daily cash balances

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

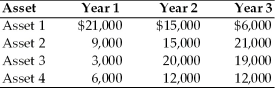

A financial manager must choose between four alternative Assets: 1,2,3,and 4.Each asset costs $35,000 and is expected to provide earnings over a three-year period as described below.  Based on the wealth maximization goal,the financial manager would choose ________.

Based on the wealth maximization goal,the financial manager would choose ________.

A) Asset 1

B) Asset 2

C) Asset 3

D) Asset 4

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Incentive plans usually tie management compensation to ________.

A) share price

B) dividends

C) coupon payments

D) inventory turnover

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The true owner(s) of the corporation is (are) the ________.

A) board of directors

B) chief executive officer

C) stockholders

D) creditors

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A major weakness of a partnership is ________.

A) the difficulty in maintaining owners' control

B) the difficulty in liquidating or transferring ownership

C) the double taxation of income

D) its high organizational costs

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows and risk are the key determinants in share price.Increased cash flow results in ________,other things remaining the same.

A) a lower share price

B) a higher share price

C) an unchanged share price

D) an undetermined share price

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A firm has just ended its calendar year making a sale in the amount of $200,000 of merchandise purchased during the year at a total cost of $150,500.Although the firm paid in full for the merchandise during the year,it is yet to collect at year end from the customer.The possible problem this firm may face is ________.

A) high taxes

B) lack of cash flow

C) inability to receive credit

D) high leverage

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

While making financing decisions,a financial manager should ________.

A) determine the appropriate mix of short-term and long-term financing

B) decide on which individual securities to select for investment

C) analyze quarterly budget and performance reports

D) improve the productivity of manufacturing products

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In partnerships,partners can readily transfer their wealth to other partners.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is an example of agency cost?

A) costs incurred for setting up an agency

B) failure of making the best investment decision

C) payment of income tax

D) payment of interest

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

________ is one of the primary responsibilities of a financial manager.

A) Monitoring quarterly tax payments

B) Analyzing budget and performance reports

C) Determining the audit policy

D) Preparing income statements

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The conflict between the goals of a firm's owners and the goals of its non-owner managers is ________.

A) the agency problem

B) incompatibility

C) serious only when profits decline

D) the window-dressing

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a corporation,the board of directors are elected by the ________.

A) chief executive officer

B) creditors

C) stockholders

D) employees

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of cash flows and risk?

A) Low cash flow and low risk result in an increase in share price.

B) High cash flow and low risk result in an increase in share price.

C) High cash flow and high risk result in an increase in share price.

D) Lo cash flow and high risk result in an increase in share price.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economic theories that a financial manager must ensure for efficient business operations,include ________.

A) supply-and-demand analysis

B) asset pricing theory

C) Porter's theory of five forces

D) Monte-Carlo simulation

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under which of the following legal forms of organization is ownership readily transferable?

A) sole proprietorships

B) partnerships

C) limited partnerships

D) corporations

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 134

Related Exams