A) reduce profit

B) reduce risk

C) increase profit

D) increase risk

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In the most basic sense,risk is a measure of the uncertainty surrounding the return that an investment will earn.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

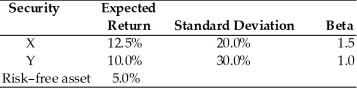

Table 8.3

Consider the following two securities X and Y.  -Using the data from Table 8.3,what is the portfolio expected return if you invest 100 percent of your money in X,borrow an amount equal to half of your own investment at the risk-free rate and invest your borrowings in asset X?

-Using the data from Table 8.3,what is the portfolio expected return if you invest 100 percent of your money in X,borrow an amount equal to half of your own investment at the risk-free rate and invest your borrowings in asset X?

A) 18.75%

B) 22.50%

C) 12.50%

D) 16.25%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Asset 1 has an expected return of 10% and a standard deviation of 20%.Asset 2 has an expected return of 15% and a standard deviation of 30%.The correlation between the two assets is -1.0.Portfolios of these two assets will have an expected return ________.

A) between 0% and 15%

B) between 10% and 15%

C) below 10%

D) above 15%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

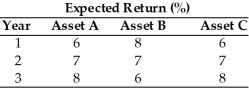

Table 8.1  -The correlation of returns between Asset A and Asset B can be characterized as ________.(See Table 8.1)

-The correlation of returns between Asset A and Asset B can be characterized as ________.(See Table 8.1)

A) perfectly positively correlated

B) perfectly negatively correlated

C) uncorrelated

D) partially correlated

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The standard deviation of a portfolio is a function of the standard deviations of the individual securities in the portfolio,the proportion of the portfolio invested in those securities,and the correlation between the returns of those securities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A beta coefficient of 0 represents an asset that ________.

A) has an expected return greater than the market portfolio

B) has the same expected return as the market portfolio

C) has returns that do not fluctuate at all

D) has an expected return equal to the risk-free rate

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A change in inflationary expectations resulting from events such as international trade embargoes or major changes in Federal Reserve policy will result in a shift in the SML.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The capital asset pricing model (CAPM)links together unsystematic risk and return for all assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Risk that affects all firms is called ________.

A) maturity risk

B) unsystematic risk

C) nondiversifiable risk

D) reinvestment risk

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The higher an asset's beta,________.

A) the more responsive it is to changing market returns

B) the less responsive it is to changing market returns

C) the higher the expected return will be in a down market

D) the lower the expected return will be in an up market

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The inclusion of assets from countries with business cycles that are not highly correlated with the U.S.business cycle reduces the portfolio's responsiveness to market movements.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Combining uncorrelated assets can reduce risk-not as effectively as combining negatively correlated assets,but more effectively than combining positively correlated assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Nico wants to invest all of his money in just two assets: the risk-free asset and the market portfolio.What is Nico's portfolio beta if he invests a quarter of his money in the market portfolio and the rest in the risk free asset?

A) 0.00

B) 0.25

C) 0.75

D) 1.00

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an investor prefers investments with greater risk even if they have lower expected returns,then he is following a ________ strategy.

A) risk-seeking

B) risk-indifferent

C) risk-averse

D) risk-neutral

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

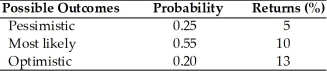

The expected value,standard deviation of returns,and coefficient of variation for asset A are ________.(See below.) Asset A

A) 10 percent,8 percent,and 1.25,respectively

B) 9.33 percent,8 percent,and 2.15,respectively

C) 9.35 percent,4.68 percent,and 2.00,respectively

D) 9.35 percent,2.76 percent,and 0.295,respectively

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The widely shared expectations of hard times ahead tend to cause investors to become less risk-averse.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A portfolio combining two assets with less than perfectly positive correlation can reduce total risk to a level below that of either of the components.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The portion of an asset's risk that is attributable to firm-specific,random causes is called ________.

A) unsystematic risk

B) nondiversifiable risk

C) market risk

D) political risk

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

As risk aversion increases ________.

A) a firm's beta will remain neutral

B) investors' required rate of return will increase

C) a firm's beta will decrease

D) investors' required rate of return will remain unchanged

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 214

Related Exams