A) Both a stock split and a stock dividend will decrease total assets.

B) Both a stock split and a stock dividend will increase total liabilities.

C) A stock split will increase total assets, but a stock dividend will not.

D) Neither a stock split nor a stock dividend will affect total assets or total liabilities.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

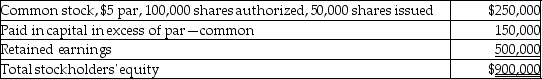

A corporation reported the following equity section on its current balance sheet. The common stock is currently selling for $12.00 per share.  Which of the following would be included in the entry to record the distribution of a 15% stock dividend?

Which of the following would be included in the entry to record the distribution of a 15% stock dividend?

A) Common Stock-$5 Par Value would be credited for $37,500.

B) Retained Earnings would be debited for $35,000.

C) Paid-In Capital in Excess of Par-Common is debited for $35,000.

D) Retained Earnings would be credited for $60,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Landess Corporation currently has 120,000 shares outstanding of $1 par value common stock. The stock was originally issued for $12 per share. On March 15, the board of directors declares a 10% stock dividend when the stock is selling for $16 per share. Which of the following is the correct journal entry to record this transaction?

A) Debit Common Stock Dividend Distributable $12,000, debit Paid-In Capital in Excess of Par-Common for $180,000 and credit Retained Earnings $192,000.

B) Debit Retained Earnings $192,000 and credit Common Stock Dividend Distributable $192,000.

C) Debit Retained Earnings $192,000, credit Common Stock Dividend Distributable $12,000 and credit Paid-In Capital in Excess of Par-Common $180,000.

D) Debit Paid-In Capital in Excess of Par-Common $192,000 and credit Retained Earnings $192,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Pearland Company has 50,000 shares of common stock outstanding and 2,000 shares of preferred stock outstanding. The common stock is $1.00 par value. The preferred stock has a $100 par value, a 5% dividend rate, and is noncumulative. On October 31, 2015, the company declares dividends of $0.25 per share for common. Provide the journal entry for the declaration of dividends.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is true of dividends?

A) Dividends are a distribution of cash, stock, or other assets to the stockholders.

B) Dividends increase assets and decrease total stockholders' equity of a corporation.

C) Dividend payments decrease paid-in capital.

D) Dividend payments increase stockholders' equity.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assume the following information for Petra Sales Company: • Common stock, $1.00 par, 200,000 issued, 180,000 outstanding • Paid-in capital in excess of Par-Common: $1,600,000 • Retained earnings: $2,440,000 • Treasury stock: 20,000 shares purchased at $12 per share If Petra Sales purchases an additional 5,000 shares of treasury stock at $14 per share, what number of shares will be shown as issued and outstanding?

A) 175,000 issued; 180,000 outstanding

B) 195,000 issued; 180,000 outstanding

C) 200,000 issued; 175,000 outstanding

D) 200,000 issued; 180,000 outstanding

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dividends in arrears are:

A) a liability on the balance sheet.

B) passed dividends on noncumulative preferred stock.

C) passed dividends on cumulative preferred stock.

D) passed dividends on common stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following explains the term "lack of mutual agency" of a corporation?

A) The liabilities of the corporation cannot be extended to the personal assets of the shareholder.

B) Shares of stock can be readily bought and sold by investors on the open market.

C) Shareholders are not authorized to sign contracts or make business commitments on behalf of the corporation.

D) Corporations pay income tax on corporate earnings, and shareholders pay personal income tax on corporate dividends and gains from sale of stock.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is the correct description of dividends in arrears, as it applies to cumulative preferred stock?

A) the cumulative amount of dividends that were not paid in previous years

B) the cumulative amount of dividends that were paid in previous years

C) the amount of dividends that were paid late

D) the amount of dividends that will be paid in the coming year

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following occurs when the board of directors declares a 3-for-1 stock split on 10,000 outstanding shares of $15 par common stock?

A) The par value of the stock remains the same.

B) The par value of the stock increases to $30 per share.

C) The number of outstanding shares remains at 10,000.

D) The number of outstanding shares increases to 30,000.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Peterson Company issued 4,000 shares of preferred stock for $240,000. The stock has a par value of $60 per share. Provide the journal entry for this transaction.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Treasury stock is a:

A) contra equity account.

B) contra asset account.

C) liability account.

D) contra liability account.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a reason for a company to announce a stock split?

A) to defend against a hostile takeover

B) to double the par value of the share

C) to reduce the market price at which the stock is trading

D) to provide the shareholders with something of value, when the company cannot afford a cash dividend

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company retires preferred stock:

A) total stockholders' equity will decrease.

B) total stockholders' equity will increase.

C) the company can record a gain or loss on retirement of stock.

D) the number of outstanding shares will go up.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Preferred stock is a stock:

A) that sells for a very high price.

B) that is distributed to employees of the company as a performance incentive.

C) that is distributed by corporations to avoid liquidation.

D) that gives its owners certain benefits over common stock.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation declares a dividend of $0.50 per share on 10,000 shares of common stock. Which of the following would be included in the entry to record the declaration?

A) Retained Earnings would be debited for $5,000.

B) Paid-In Capital in Excess of Par-Common would be credited for $5,000.

C) Retained Earnings would be credited for $5,000.

D) Dividends Payable-Common would be debited for $5,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

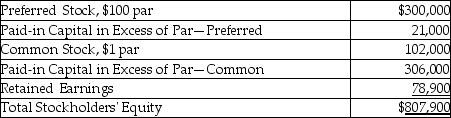

The following information is from the balance sheet of Tudor Corporation as of December 31, • 2015.  What was the total paid-in capital as of December 31, 2015?

What was the total paid-in capital as of December 31, 2015?

A) $606,000

B) $807,900

C) $729,000

D) $708,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Outstanding stock refers to the:

A) shares of stock that are held by the stockholders.

B) shares of stock that have been sold for the highest price.

C) total amount of stock that has been authorized by state law.

D) total amount of stock that has not been sold yet.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The par value of stock is:

A) the current selling price of stock.

B) the highest price for which a share can sell.

C) the price paid if the corporation purchases its own stock back.

D) the amount assigned by a company to a share of its stock.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

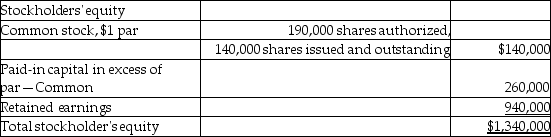

On June 30, 2015, Roger Company showed the following data on the equity section of their balance sheet:  On July 1, 2015, Roger declared and distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would be the new balance in Paid-In Capital in Excess of Par-Common?

On July 1, 2015, Roger declared and distributed a 5% stock dividend. The market value of the stock at that time was $13 per share. Following this transaction, what would be the new balance in Paid-In Capital in Excess of Par-Common?

A) $286,000

B) $284,000

C) $260,000

D) $344,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 158

Related Exams