A) $15.625.

B) $14.620.

C) $18.504.

D) $17.314.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a labor intensive company in which more overhead is used by the more highly skilled and paid employees,which activity base would be most appropriate for applying overhead to production?

A) Direct labor cost.

B) Direct material cost.

C) Direct labor hours.

D) Machine hours.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

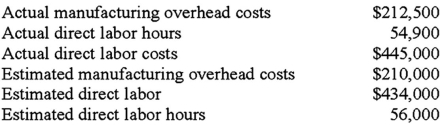

The following information has been gathered for the GHI Manufacturing Company for its fiscal year ending December 31:  What is the predetermined manufacturing overhead rate per direct labor hour?

What is the predetermined manufacturing overhead rate per direct labor hour?

A) $3.87.

B) $3.79.

C) $3.83.

D) $3.75.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

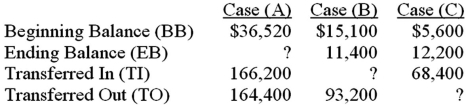

For Case (B) above,what is the Transferred-In (TI) ?

For Case (B) above,what is the Transferred-In (TI) ?

A) $96,900.

B) $119,700.

C) $89,500.

D) $66,700.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If a company has three cost pools,it should have three different cost allocation bases.This would be the case if there was a need for information on a departmental basis and if differences exist in hours or rates,or whatever the allocation base is.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The predetermined overhead rate for manufacturing overhead for Mansfield Corporation was $8.00 per direct labor hour.The estimated labor rate was $10.00 per hour.If the estimated direct labor cost was $150,000,what was the estimated manufacturing overhead?

A) $93,750.

B) $75,000.

C) $120,000.

D) $15,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Lo-crete produces quick setting concrete mix.Production of 200,000 tons was started in April,190,000 tons were completed.Material costs were $3,152,000 for the month while conversion costs were $591,000.There was no beginning work-in-process;the ending work-in-process was 70% complete.What is the material cost of the product that remains in work-in-process?

A) $315,200.

B) $157,600.

C) $112,000.

D) $160,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is (are) false regarding cost allocations and product costing? (A) It is easier to determine the individual product cost for a manufacturer than it is for a wholesaler.(B) In general,indirect costs are assigned,while direct costs are allocated.

A) Only A is false.

B) Only B is false.

C) Both A and B are false.

D) Neither A nor B is false.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Trans-X processes credit card receipts for local banks.Trans-X processed 1,400,000 receipts in October.All receipts are processed the same day they are received.October costs were labor of $14,000 and overhead of $28,000.What is the cost to process 1,000 receipts?

A) $10.00.

B) $30.00.

C) $20.00.

D) $42.00.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sweet Lu Industries applies manufacturing overhead to its products on the basis of 50% of direct material cost.If a job had $35,000 of manufacturing overhead applied to it during May,the direct materials assigned to the job was:

A) $17,500.

B) $35,000.

C) $70,000.

D) $140,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Overestimating a period's allocation base will understate the predetermined overhead rate.The denominator of the rate will be too high,causing the rate to be too low.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The process of first allocating costs to intermediate cost pools and then to the individual cost objects using different allocation bases is a(n) :

A) continuous flow process.

B) cost management system.

C) two-stage allocation system.

D) operations cost.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

If the Beginning Balance (BB)equals the Ending Balance (EB),then the Transfers In (TI)equal the Transfers Out (TO).No change in the beginning and ending inventory balances,so the outputs (TO)will equal the inputs (TI).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A system that mass-produces a single,homogenous output in a continuous process is a(n) :

A) continuous flow process.

B) cost management system.

C) two-stage allocation system.

D) operations cost.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Slurpy produces soft drinks and sodas.Production of 100,000 liters was started in February,85,000 liters were completed.Material costs were $38,220 for the month while conversion costs were $16,380.There was no beginning work-in-process;the ending work-in-process was 40% complete.What is the cost of the product that remains in work-in-process?

A) $16,380.

B) $51,000.

C) $3,600.

D) $9,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Cost Flow Diagram for product costing includes all of the following costs except:

A) selling expenses.

B) direct materials.

C) direct labor.

D) fixed manufacturing overheaD.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

The two-stage cost allocation process allocates costs to multiple cost pools and then to individual cost objects using different allocation bases.This is the definition of two-stage allocation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The predetermined manufacturing overhead rate for the year was $14.00 per direct labor hour;employees were paid $17.50 per hour.If the estimated direct labor cost was $315,000,what was the estimated manufacturing overhead?

A) $22,500.

B) $90,000.

C) $252,000.

D) $393,750.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

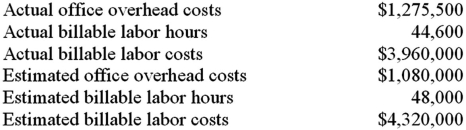

The following information has been gathered for Cheatham Law Offices for its fiscal year ending December 31:  What is the predetermined office overhead rate per billable labor hour?

What is the predetermined office overhead rate per billable labor hour?

A) $28.60.

B) $26.57.

C) $22.50.

D) $24.22.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

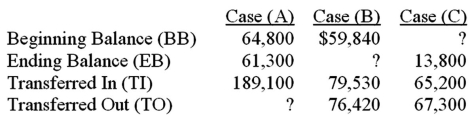

For Case (A) above,what is the Transferred-Out (TO) ?

For Case (A) above,what is the Transferred-Out (TO) ?

A) $185,600.

B) $192,600.

C) $126,100.

D) $178,890.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 88

Related Exams