A) $88,000

B) $353,000

C) $476,000

D) -$177,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

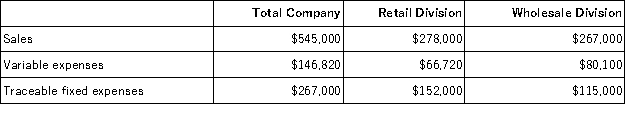

Rollison Corporation has two divisions: Retail Division and Wholesale Division.The following data are for the most recent operating period:  The common fixed expenses of the company are $76,300. The Wholesale Division's break-even sales in dollars is closest to:

The common fixed expenses of the company are $76,300. The Wholesale Division's break-even sales in dollars is closest to:

A) $164,286

B) $217,686

C) $273,286

D) $469,884

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

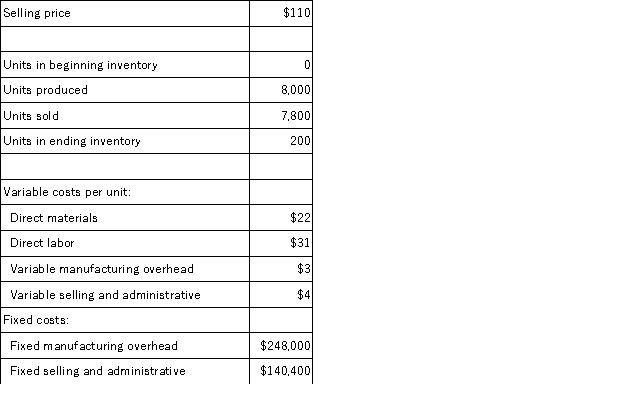

Chown Corporation,which has only one product,has provided the following data concerning its most recent month of operations:  The total gross margin for the month under the absorption costing approach is:

The total gross margin for the month under the absorption costing approach is:

A) $196,800

B) $179,400

C) $390,000

D) $7,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

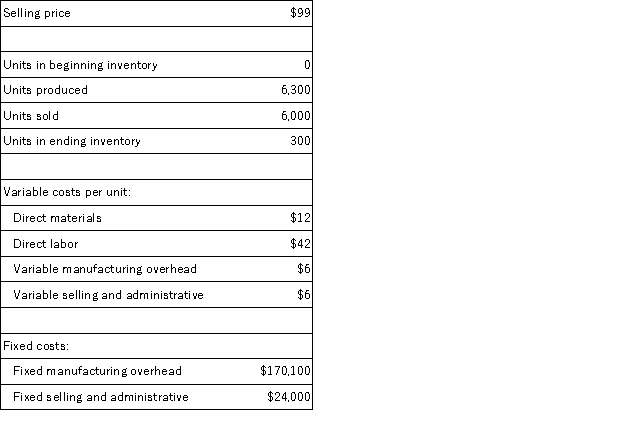

Aaker Corporation,which has only one product,has provided the following data concerning its most recent month of operations:  The total contribution margin for the month under variable costing is:

The total contribution margin for the month under variable costing is:

A) $72,000

B) $27,900

C) $234,000

D) $198,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

George Corporation has no beginning inventory and manufactures a single product.If the number of units produced exceeds the number of units sold,then net operating income under the absorption method for the year will:

A) be equal to the net operating income under variable costing.

B) be greater than the net operating income under variable costing.

C) be equal to the net operating income under variable costing plus total fixed manufacturing costs.

D) be equal to the net operating income under variable costing less total fixed manufacturing costs.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

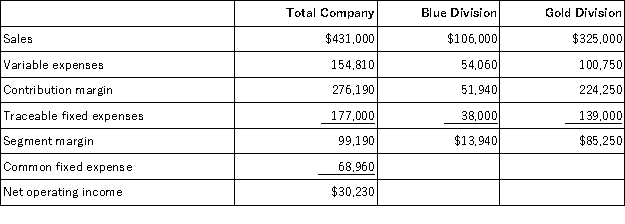

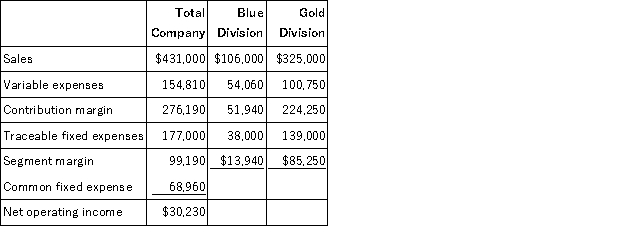

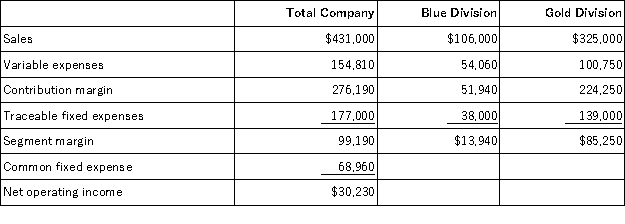

Criblez Corporation has two divisions: Blue Division and Gold Division.The following report is for the most recent operating period:  The Gold Division's break-even sales is closest to:

The Gold Division's break-even sales is closest to:

A) $276,812

B) $301,391

C) $383,825

D) $201,449

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Criblez Corporation has two divisions: Blue Division and Gold Division.The following report is for the most recent operating period:  The company's overall break-even sales is closest to:

The company's overall break-even sales is closest to:

A) $104,825

B) $383,825

C) $279,000

D) $299,645

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

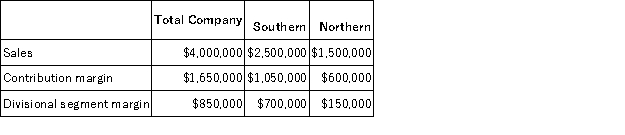

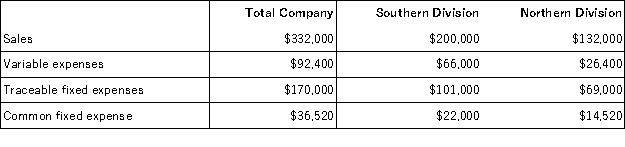

Nantua Corporation has two divisions,Southern and Northern.The following information was taken from last year's income statement segmented by division:  Net operating income last year for Nantua Corporation was $400,000. In last year's income statement segmented by division,what were Nantua's total common fixed expenses?

Net operating income last year for Nantua Corporation was $400,000. In last year's income statement segmented by division,what were Nantua's total common fixed expenses?

A) $450,000

B) $800,000

C) $1,250,000

D) $1,300,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

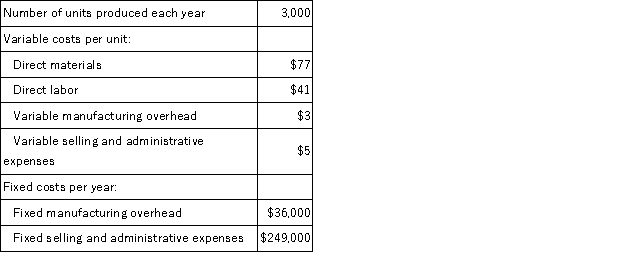

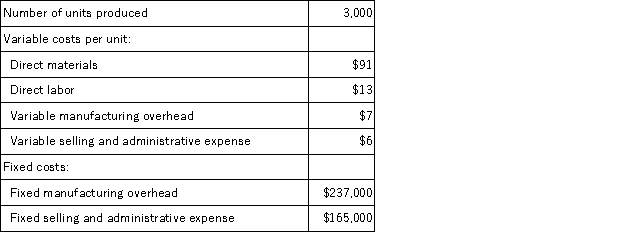

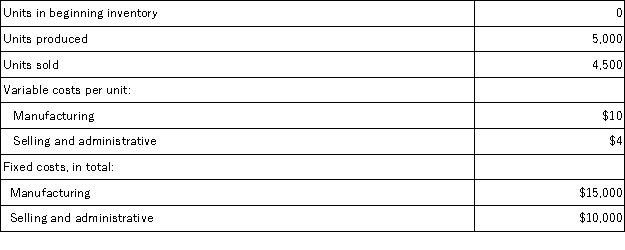

Ronan Corporation produces a single product and has the following cost structure:  Required:

Compute the unit product cost under variable costing.Show your work!

Required:

Compute the unit product cost under variable costing.Show your work!

Correct Answer

verified

Correct Answer

verified

Multiple Choice

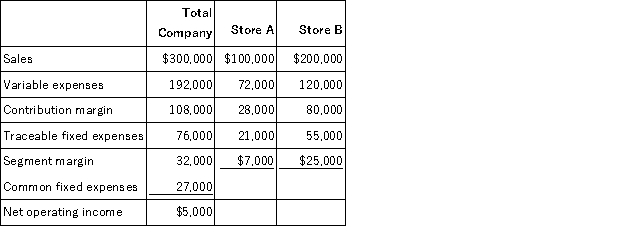

O'Neill,Incorporated's segmented income statement for the most recent month is given below.  For each of the following questions,refer back to the above original data. The marketing department believes that a promotional campaign at Store A costing $6,000 will increase sales by $15,000.If its plan is adopted,overall company net operating income should:

For each of the following questions,refer back to the above original data. The marketing department believes that a promotional campaign at Store A costing $6,000 will increase sales by $15,000.If its plan is adopted,overall company net operating income should:

A) decrease by $1,800

B) decrease by $10,200

C) increase by $10,200

D) increase by $1,800

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

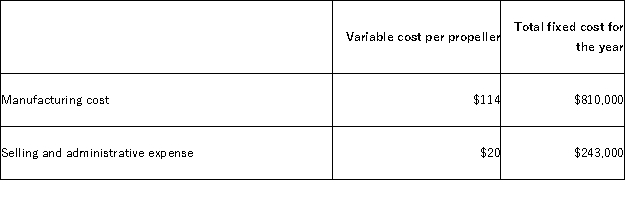

Cutterski Corporation manufactures a propeller.Shown below is Cutterski's cost structure:  In its first year of operations,Cutterski produced 60,000 propellers but only sold 54,000. What would Cutterski report as its cost of goods sold under absorption costing?

In its first year of operations,Cutterski produced 60,000 propellers but only sold 54,000. What would Cutterski report as its cost of goods sold under absorption costing?

A) $6,156,000

B) $6,885,000

C) $6,966,000

D) $8,208,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Criblez Corporation has two divisions: Blue Division and Gold Division.The following report is for the most recent operating period:  The Blue Division's break-even sales is closest to:

The Blue Division's break-even sales is closest to:

A) $383,825

B) $218,286

C) $77,551

D) $112,163

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

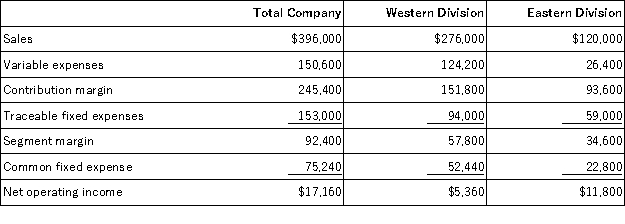

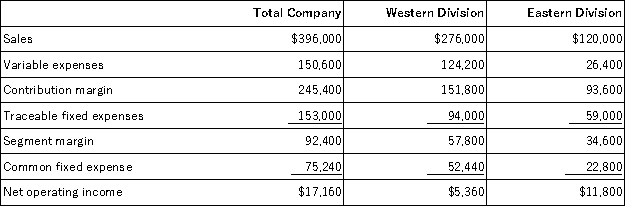

Keefe Corporation has two divisions: Western Division and Eastern Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales. The Eastern Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales. The Eastern Division's break-even sales is closest to:

A) $104,872

B) $368,309

C) $75,641

D) $172,103

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sharron Inc. ,which produces a single product,has provided the following data for its most recent month of operations:  There were no beginning or ending inventories.The variable costing unit product cost was:

There were no beginning or ending inventories.The variable costing unit product cost was:

A) $111 per unit

B) $190 per unit

C) $117 per unit

D) $110 per unit

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data were provided by Rider,Inc,which produces a single product:  Under variable costing,the unit product cost is:

Under variable costing,the unit product cost is:

A) $14 per unit

B) $13 per unit

C) $10 per unit

D) $16 per unit

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Keefe Corporation has two divisions: Western Division and Eastern Division.The following report is for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales. What is the company's overall net operating income if it operates at the break-even points for its two divisions?

The common fixed expenses have been allocated to the divisions on the basis of sales. What is the company's overall net operating income if it operates at the break-even points for its two divisions?

A) $17,160

B) ($75,240)

C) ($228,240)

D) $0

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

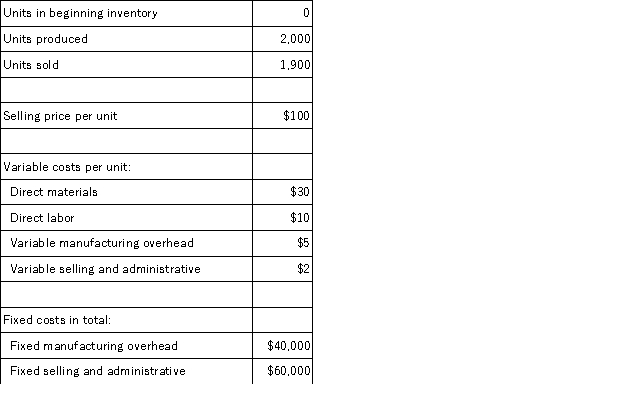

Italia Espresso Machina Inc.produces a single product.Data concerning the company's operations last year appear below:  Required:

a.Compute the unit product cost under both absorption and variable costing.

b.Prepare an income statement for the year using absorption costing.

c.Prepare a contribution format income statement for the year using variable costing.

d.Prepare a report reconciling the difference in net operating income between absorption and variable costing for the year.

Required:

a.Compute the unit product cost under both absorption and variable costing.

b.Prepare an income statement for the year using absorption costing.

c.Prepare a contribution format income statement for the year using variable costing.

d.Prepare a report reconciling the difference in net operating income between absorption and variable costing for the year.

Correct Answer

verified

a. 11eaa3fe_32d7_b71a_908b_a3b18835715a_TB2461_00 b.Absorption costing income statement 11eaa3fe_32d7_de2b_908b_c7de5b1b53da_TB2461_00 c.Contribution format income statement 11eaa3fe_32d7_de2c_908b_d7664fce9308_TB2461_00 d.Reconciliation

Units in ending inventory = Units in beginning inventory + Units produced - Units sold

= 0 units + 2,000 units - 1,900 units = 100 units

Manufacturing overhead deferred in (released from)inventory = Fixed manufacturing overhead in ending inventory - Fixed manufacturing overhead in beginning inventory = ($20 per unit × 100 units)- $0 = $2,000 11eaa3fe_32d8_053d_908b_0388a2c910e8_TB2461_00

Correct Answer

verified

Multiple Choice

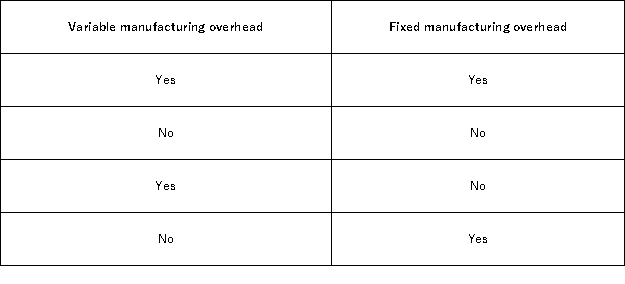

Under absorption costing,product costs include:

A) Option A

B) Option B

C) Option C

D) Option D

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Pevy Corporation has two divisions: Southern Division and Northern Division.The following data are for the most recent operating period:  The common fixed expenses have been allocated to the divisions on the basis of sales. The Northern Division's break-even sales is closest to:

The common fixed expenses have been allocated to the divisions on the basis of sales. The Northern Division's break-even sales is closest to:

A) $104,400

B) $131,900

C) $86,250

D) $286,163

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

Brummitt Corporation has two divisions: the BAJ Division and the CBB Division.The corporation's net operating income is $10,700.The BAJ Division's divisional segment margin is $76,100 and the CBB Division's divisional segment margin is $42,300.What is the amount of the common fixed expense not traceable to the individual divisions?

A) $86,800

B) $107,700

C) $53,000

D) $118,400

F) B) and C)

Correct Answer

verified

B

Correct Answer

verified

Showing 1 - 20 of 223

Related Exams