A) You hold two bonds,a 10-year,zero coupon,issue and a 10-year bond that pays a 6% annual coupon.The same market rate,6%,applies to both bonds.If the market rate rises from its current level,the zero coupon bond will experience the larger percentage decline.

B) The time to maturity does not affect the change in the value of a bond in response to a given change in interest rates.

C) You hold two bonds.One is a 10-year,zero coupon,bond and the other is a 10-year bond that pays a 6% annual coupon.The same market rate,6%,applies to both bonds.If the market rate rises from the current level,the zero coupon bond will experience the smaller percentage decline.

D) The shorter the time to maturity,the greater the change in the value of a bond in response to a given change in interest rates,other things held constant.

E) The longer the time to maturity,the smaller the change in the value of a bond in response to a given change in interest rates.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

A bond that is callable has a chance of being retired earlier than its stated term to maturity.Therefore,if the yield curve is upward sloping,an outstanding callable bond should have a lower yield to maturity than an otherwise identical noncallable bond.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Restrictive covenants are designed primarily to protect bondholders by constraining the actions of managers.Such covenants are spelled out in bond indentures.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ryngaert Inc.recently issued noncallable bonds that mature in 15 years.They have a par value of $1,000 and an annual coupon of 5.7%.If the current market interest rate is 7.7%,at what price should the bonds sell?

A) $924.70

B) $652.25

C) $1,015.52

D) $891.68

E) $825.63

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

McCue Inc.'s bonds currently sell for $1,250.They pay a $90 annual coupon,have a 25-year maturity,and a $1,000 par value,but they can be called in 5 years at $1,050.Assume that no costs other than the call premium would be incurred to call and refund the bonds,and also assume that the yield curve is horizontal,with rates expected to remain at current levels on into the future.What is the difference between this bond's YTM and its YTC? (Subtract the YTC from the YTM;it is possible to get a negative answer. )

A) 2.04%

B) 2.33%

C) 2.77%

D) 2.62%

E) 2.98%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) 10-year,zero coupon bonds have more reinvestment risk than 10-year,10% coupon bonds.

B) A 10-year,10% coupon bond has less reinvestment risk than a 10-year,5% coupon bond (assuming all else equal) .

C) The total (rate of) return on a bond during a given year is the sum of the coupon interest payments received during the year and the change in the value of the bond from the beginning to the end of the year,divided by the bond's price at the beginning of the year.

D) The price of a 20-year,10% bond is less sensitive to changes in interest rates than the price of a 5-year,10% bond.

E) A $1,000 bond with $100 annual interest payments that has 5 years to maturity and is not expected to default would sell at a discount if interest rates were below 9% and at a premium if interest rates were greater than 11%.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Income bonds pay interest only if the issuing company actually earns the indicated interest.Thus,these securities cannot bankrupt a company,and this makes them safer from an investor's perspective than regular bonds.

B) False

Correct Answer

verified

False

Correct Answer

verified

Multiple Choice

Three $1,000 face value,10-year,noncallable,bonds have the same amount of risk,hence their YTMs are equal.Bond 8 has an 8% annual coupon,Bond 10 has a 10% annual coupon,and Bond 12 has a 12% annual coupon.Bond 10 sells at par.Assuming that interest rates remain constant for the next 10 years,which of the following statements is CORRECT?

A) Bond 8's current yield will increase each year.

B) Since the bonds have the same YTM,they should all have the same price,and since interest rates are not expected to change,their prices should all remain at their current levels until maturity.

C) Bond 12 sells at a premium (its price is greater than par) ,and its price is expected to increase over the next year.

D) Bond 8 sells at a discount (its price is less than par) ,and its price is expected to increase over the next year.

E) Over the next year,Bond 8's price is expected to decrease,Bond 10's price is expected to stay the same,and Bond 12's price is expected to increase.

G) C) and E)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal,senior debt generally has a lower yield to maturity than subordinated debt.

B) An indenture is a bond that is less risky than a mortgage bond.

C) The expected return on a corporate bond will generally exceed the bond's yield to maturity.

D) If a bond's coupon rate exceeds its yield to maturity,then its expected return to investors will also exceed its yield to maturity.

E) Under our bankruptcy laws,any firm that is in financial distress will be forced to declare bankruptcy and then be liquidated.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

As a general rule,a company's debentures have higher required interest rates than its mortgage bonds because mortgage bonds are backed by specific assets while debentures are unsecured.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a 10-year,$1,000 par,zero coupon bond were issued at a price that gave investors a 10% yield to maturity,and if interest rates then dropped to the point where rd = YTM = 5%,the bond would sell at a premium over its $1,000 par value.

B) If a 10-year,$1,000 par,10% coupon bond were issued at par,and if interest rates then dropped to the point where rd = YTM = 5%,we could be sure that the bond would sell at a premium above its $1,000 par value.

C) Other things held constant,including the coupon rate,a corporation would rather issue noncallable bonds than callable bonds.

D) Other things held constant,a callable bond would have a lower required rate of return than a noncallable bond because it would have a shorter expected life.

E) Bonds are exposed to both reinvestment risk and price risk.Longer-term low-coupon bonds,relative to shorter-term high-coupon bonds,are generally more exposed to reinvestment risk than price risk.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) All else equal,high-coupon bonds have less reinvestment risk than low-coupon bonds.

B) All else equal,long-term bonds have less price risk than short-term bonds.

C) All else equal,low-coupon bonds have less price risk than high-coupon bonds.

D) All else equal,short-term bonds have less reinvestment risk than long-term bonds.

E) All else equal,long-term bonds have less reinvestment risk than short-term bonds.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Assuming all else is constant,which of the following statements is CORRECT?

A) Other things held constant,a 20-year zero coupon bond has more reinvestment risk than a 20-year coupon bond.

B) Other things held constant,for any given maturity,a 1.0 percentage point decrease in the market interest rate would cause a smaller dollar capital gain than the capital loss stemming from a 1.0 percentage point increase in the interest rate.

C) From a corporate borrower's point of view,interest paid on bonds is not tax-deductible.

D) Other things held constant,price sensitivity as measured by the percentage change in price due to a given change in the required rate of return decreases as a bond's maturity increases.

E) For a bond of any maturity,a 1.0 percentage point increase in the market interest rate (rd) causes a larger dollar capital loss than the capital gain stemming from a 1.0 percentage point decrease in the interest rate.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a coupon bond is selling at par,its current yield equals its yield to maturity.

B) If a coupon bond is selling at a discount,its price will continue to decline until it reaches its par value at maturity.

C) If interest rates increase,the price of a 10-year coupon bond will decline by a greater percentage than the price of a 10-year zero coupon bond.

D) If a bond's yield to maturity exceeds its annual coupon,then the bond will trade at a premium.

E) If a coupon bond is selling at a premium,its current yield equals its yield to maturity.

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If the Federal Reserve unexpectedly announces that it expects inflation to increase,then we would probably observe an immediate increase in bond prices.

B) The total yield on a bond is derived from dividends plus changes in the price of the bond.

C) Bonds are generally regarded as being riskier than common stocks,and therefore bonds have higher required returns.

D) Bonds issued by larger companies always have lower yields to maturity (due to less risk) than bonds issued by smaller companies.

E) The market price of a bond will always approach its par value as its maturity date approaches,provided the bond's required return remains constant.

G) D) and E)

Correct Answer

verified

E

Correct Answer

verified

Multiple Choice

A 12-year bond has an annual coupon of 9%.The coupon rate will remain fixed until the bond matures.The bond has a yield to maturity of 7%.Which of the following statements is CORRECT?

A) If market interest rates decline,the price of the bond will also decline.

B) The bond is currently selling at a price below its par value.

C) If market interest rates remain unchanged,the bond's price one year from now will be lower than it is today.

D) The bond should currently be selling at its par value.

E) If market interest rates remain unchanged,the bond's price one year from now will be higher than it is today.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If a bond is selling at a discount,the yield to call is a better measure of return than is the yield to maturity.

B) On an expected yield basis,the expected capital gains yield will always be positive because an investor would not purchase a bond with an expected capital loss.

C) On an expected yield basis,the expected current yield will always be positive because an investor would not purchase a bond that is not expected to pay any cash coupon interest.

D) If a coupon bond is selling at par,its current yield equals its yield to maturity,and its expected capital gains yield is zero.

E) The current yield on Bond A exceeds the current yield on Bond B;therefore,Bond A must have a higher yield to maturity than Bond B.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

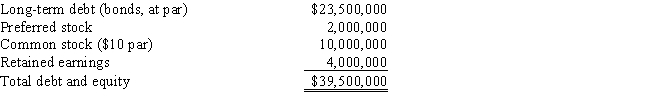

In order to accurately assess the capital structure of a firm,it is necessary to convert its balance sheet figures from historical book values to market values.KJM Corporation's balance sheet (book values) as of today is as follows:

The bonds have a 8.4% coupon rate,payable semiannually,and a par value of $1,000.They mature exactly 10 years from today.The yield to maturity is 11%,so the bonds now sell below par.What is the current market value of the firm's debt?

The bonds have a 8.4% coupon rate,payable semiannually,and a par value of $1,000.They mature exactly 10 years from today.The yield to maturity is 11%,so the bonds now sell below par.What is the current market value of the firm's debt?

A) $19,849,158

B) $21,238,599

C) $15,085,360

D) $18,459,717

E) $22,231,057

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Floating-rate debt is advantageous to investors because the interest rate moves up if market rates rise.Since floating-rate debt shifts price risk to companies,it offers no advantages to corporate issuers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Morin Company's bonds mature in 8 years,have a par value of $1,000,and make an annual coupon interest payment of $65.The market requires an interest rate of 6.7% on these bonds.What is the bond's price?

A) $987.92

B) $1,155.86

C) $770.58

D) $1,215.14

E) $1,047.19

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 92

Related Exams