Correct Answer

verified

Correct Answer

verified

Multiple Choice

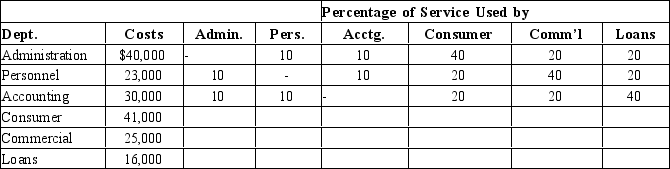

Astoria Savings & Loans of New York has three revenue-generating departments: Consumer accounts, Commercial accounts, and Loans. The bank also has three service areas: administration, personnel, and accounting. The direct costs per month and the interdepartmental service structure are shown below:  How much cost would be allocated to the Commercial account area from administration using the direct method?

How much cost would be allocated to the Commercial account area from administration using the direct method?

A) $40,000

B) $5,000

C) $10,000

D) $20,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The sales-value-at-split-off method allocates joint production costs based on each product's share of

A) sales value revenues have not been realized at the split-off point.

B) costs realized at the split-off point.

C) final sales value less further processing costs after the split-off point.

D) units produced at the split-off point.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following methods allocates joint production costs based on the pounds of product produced?

A) sales-value-at-split-off method

B) physical units method

C) constant gross margin percentage method

D) replacement cost method

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

The method of allocating costs, allocates costs from support to producing departments.

Correct Answer

verified

direct

Correct Answer

verified

Multiple Choice

Oxide Company has two support departments (S1 and S2) and two producing departments (X and Y) . Department S1 serves Departments S2, X, and Y in the following percentages, respectively: 10%, 35%, 55%. Department S2 serves Departments S1, X, and Y in the following percentages, respectively: 6%, 50%, and 44%. Direct department costs for S1, S2, X, and Y are $15,000, $8,000, $105,000, and $97,500, respectively. What is S2's cost equation?

A) S2 = $8,000 + 0.10S1

B) S2 = $8,000 + 0.06S1

C) S2 = $15,000 + 0.10S1

D) S2 = $15,000 + 0.06S1

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

Budgeted rates are allocated based on original capacity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Allocation increases total costs.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The reciprocal method of allocation recognizes only some of the support departments' interactions.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the major objectives of allocation as identified by the IMA would NOT be relevant in a service organization?

A) to obtain a mutually agreeable price

B) to compute product-line profitability

C) to predict the economic effects of planning and control

D) all of the above are objectives of allocation

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the allocation is for product costing, the allocation of variable support department costs would be calculated as

A) Actual rate × Actual usage.

B) Actual rate × Budgeted usage.

C) Budgeted rate × Actual usage.

D) Budgeted rate × Budgeted usage.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Essay

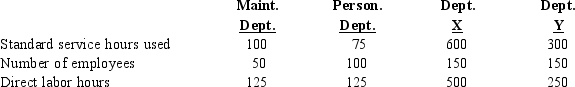

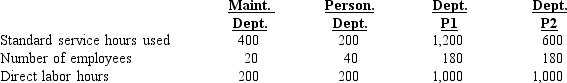

Diane's Pottery Manufacturing Company has two support departments, Maintenance Department and Personnel Department, and two producing departments, X and Y. The Maintenance Department costs of $30,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $4,500 are allocated on the basis of number of employees. The direct costs of Departments X and Y are $9,000 and $15,000, respectively.

Data on standard service hours and number of employees are as follows:

What are the total overhead costs associated with Department X after allocating the Maintenance and Personnel

Departments using the direct method?

a. $31,250

b. $29,000

c. $11,250

d. $9,000

What are the total overhead costs associated with Department X after allocating the Maintenance and Personnel

Departments using the direct method?

a. $31,250

b. $29,000

c. $11,250

d. $9,000

Correct Answer

verified

a

11eab519_9515_6ab0_9198_291e982c0bae_TB2045_00

Correct Answer

verified

Multiple Choice

Figure 7-7 Garden of Eden Company manufactures two products, Brights and Dulls, from a joint process. A production run costs $50,000 and results in 250 units of Brights and 1,000 units of Dulls. Both products must be processed past the split-off point, incurring separable costs for Brights of $60 per unit and $40 per unit for Dulls. The market price is $250 for Brights and $200 for Dulls. -Refer to Figure 7-7. What is the amount of joint costs allocated to Brights using the net realizable value method?

A) $11,446

B) $11,906

C) $50,000

D) $-0-

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

are mutually beneficial costs to joint product costing.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Joint costs are

A) separable.

B) allocated on the basis of cause and effect relationships.

C) allocated arbitrarily.

D) all of the above.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

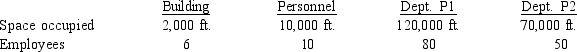

Fairfield Company allocates common Building Department costs to producing departments (P1 and P2) based on space occupied, and it allocates common Personnel Department costs based on the number of employees. Space occupancy and employee data are as follows:  If Fairfield Company uses the direct allocation method, the ratio representing the portion of building costs allocated to Department P1 is

If Fairfield Company uses the direct allocation method, the ratio representing the portion of building costs allocated to Department P1 is

A) 190,000/202,000.

B) 2,000/120,000.

C) 120,000/202,000.

D) 120,000/190,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

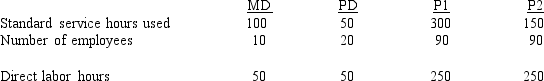

Figure 7-6

Golden Leaves Company has two support departments, Maintenance Department (MD) and Personnel Department (PD) , and two producing departments, P1 and P2. The Maintenance Department costs of $30,000 are allocated on the basis of standard service used. The Personnel Department costs of $4,500 are allocated on the basis of number of employees. The direct costs of Departments P1 and P2 are $9,000 and $15,000, respectively.

Data on standard service hours and number of employees are as follows:

-Refer to Figure 7-6. Using the direct method, the cost of the Maintenance Department allocated to Department P1 is

-Refer to Figure 7-6. Using the direct method, the cost of the Maintenance Department allocated to Department P1 is

A) $15,000.

B) $10,000.

C) $20,000.

D) $30,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gravity Company has two support departments, Maintenance Department (MD) and Personnel Department (PD) , and two producing departments, P1 and P2. The Maintenance Department costs of $120,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $18,000 are allocated on the basis of number of employees. The direct costs of Departments P1 and P2 are $36,000 and $60,000, respectively. Data on standard service hours and number of employees are as follows:

What are the total overhead costs associated with P1 after allocating the Maintenance and Personnel Departments using the direct method?

What are the total overhead costs associated with P1 after allocating the Maintenance and Personnel Departments using the direct method?

A) $120,000

B) $125,000

C) $36,000

D) $18,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

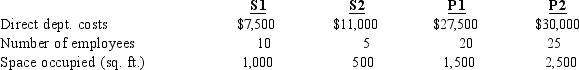

Howard Company has two support departments (S1 and S2) and two producing departments (P1 and P2) . Department S1 costs are allocated on the basis of number of employees, and Department S2 costs are allocated on the basis of space occupied expressed in square feet.

Data on direct department costs, number of employees, and space occupied are as follows:

If Howard used the reciprocal method, the algebraic equation expressing the total costs allocated from S1 is

If Howard used the reciprocal method, the algebraic equation expressing the total costs allocated from S1 is

A) S1 = $7,500 + 0.10S2.

B) S1 = $7,500 + 0.20S2.

C) S1 = $10,000 + 0.20S2.

D) S1 = $10,000 + 0.10S2.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

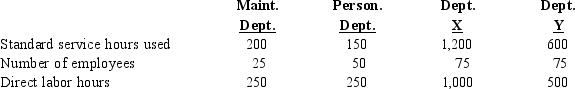

Morton Manufacturing Company has two support departments, Maintenance Department and Personnel Department, and two producing departments, X and Y. The Maintenance Department costs of $90,000 are allocated on the basis of standard service hours used. The Personnel Department costs of $13,500 are allocated on the basis of number of employees. The direct costs of Departments X and Y are $27,000 and $45,000, respectively.

Data on standard service hours and number of employees are as follows:

Predetermined overhead rates for Departments X and Y, respectively, are based on direct labor hours.

What is the overhead rate for Department X assuming the direct method is used?

a. $27.00

b. $81.00

c. $46.88

d. $93.75

Predetermined overhead rates for Departments X and Y, respectively, are based on direct labor hours.

What is the overhead rate for Department X assuming the direct method is used?

a. $27.00

b. $81.00

c. $46.88

d. $93.75

Correct Answer

verified

d

11eab519_9514_ce6a_9198_f979c5f8215b_TB2045_00

Correct Answer

verified

Showing 1 - 20 of 171

Related Exams